I've been retired for many years now and uncertain about my financial future.

Meeting Annuity Educator was a gift from heaven for which I am so greatful.

He took the mystery out of the annuity and made the way clear for the best investment particularly for my

situation.

He took the time to explain what I needed to know to make the best decision ...and he made the process effortless.

I feel secure in the decisions made for my future and for my family thanks to Educator's guidance. Thanks so much!

I would recommend Annuity Educator with any financially needs but his expertise is annuities.

Our previous financial advisors sold me an annuity with little or no advice. He used the explanation of "trust

me". My

bad! Once I realized the importance of insuring my investments as part of my portfolio I solicited a number of

annuity

brokers. Annuity Educator was our expert. He came to our house and offered a number of types of annuities fully

explaining the

choices. Again, I fully recommend Annuity Educator.

As we prepared for retirement, we were constantly advised to make sure we diversified our assets. One potential

area

of investment was an annuity Thank God, we were able to find Annuity Educator. As the AnnuityEducator, he

patiently took

the time to discuss the differences in type, return of investment, length before receiving funds, and how

annuities

would meld with our other retirement investments. Then Annuity Educator researched and found the best annuity for

our situation.

Now, after buying this annuity, in addition to our other investments, we feel confident and secure with oiur

retirement future.

After shopping around I found out that the Annuity Educator is an excellent source in case if you looking to open

an annuity account. Annuity Educator is a person you have to meet. It so easy to work with him. He makes me feel

that I got most voluble and full information on existing annuities on the market. It was not my first experience

with annuities and I choose to go with Annuity Educator. I am strongly recommended FAA to all my friends

I was in their office recently waiting for a meeting and just happened to be there when another husband and wife

arrived for their own appointment. WOW - talk about happy customers! I got an unexpected opportunity to hear from

a long term client how much they liked the service and knowledge they had received from working with Annuity

Educator.

Annuity Educator has been a great help in providing the information that I needed to evaluate my retirement plans,

and following the review to obtain the annuity product that best fit our family's needs; and further, becoming a

friend in the process. He survived my intense review, maintaining a professional yet friendly attitude, and I

highly recommend working with him!

As a 70 yr old retired & successful businessman, I have much knowledge in this arena, as my son also is a highly

regarded CFP, broker, etc., with all licenses to serve anyone's financial needs in all areas in So Carolina.

Annuity Educator is extremely well versed, a professional advisor who guided me, caring about my needs only, not

his, to a terrific vehicle for my annuity. Aside he's a very delightful, easy man to deal with, a great listener,

with excellent follow up. I highly recommend him, period. Jeff F.

After searching for the highest return on an annuity product my wife and I decided on Annuity Educator as the

person to help us through the maze of finding the right product for us. Annuity Educator was able to use his

database of annuity products to match up our needs with a life insurance company in Texas. Previously we were a

customer of a large national investment company that sold us a variable annuity product that unfortunately had

very high annual fees with only an average yearly payout. Annuity Educator was able to find several interesting

annuity products, but one in particular interested us. We are now delighted clients of them and we own a great

annuity product that has far lower annual fees, and a substantially higher annual payout. The difference is great.

My experience with Annuity Educator was beyond all my expectations. I met a lot of advisors from top financial

companies and none of them earned either my respect or my money. With Annuity Educator I felt comfortable as he

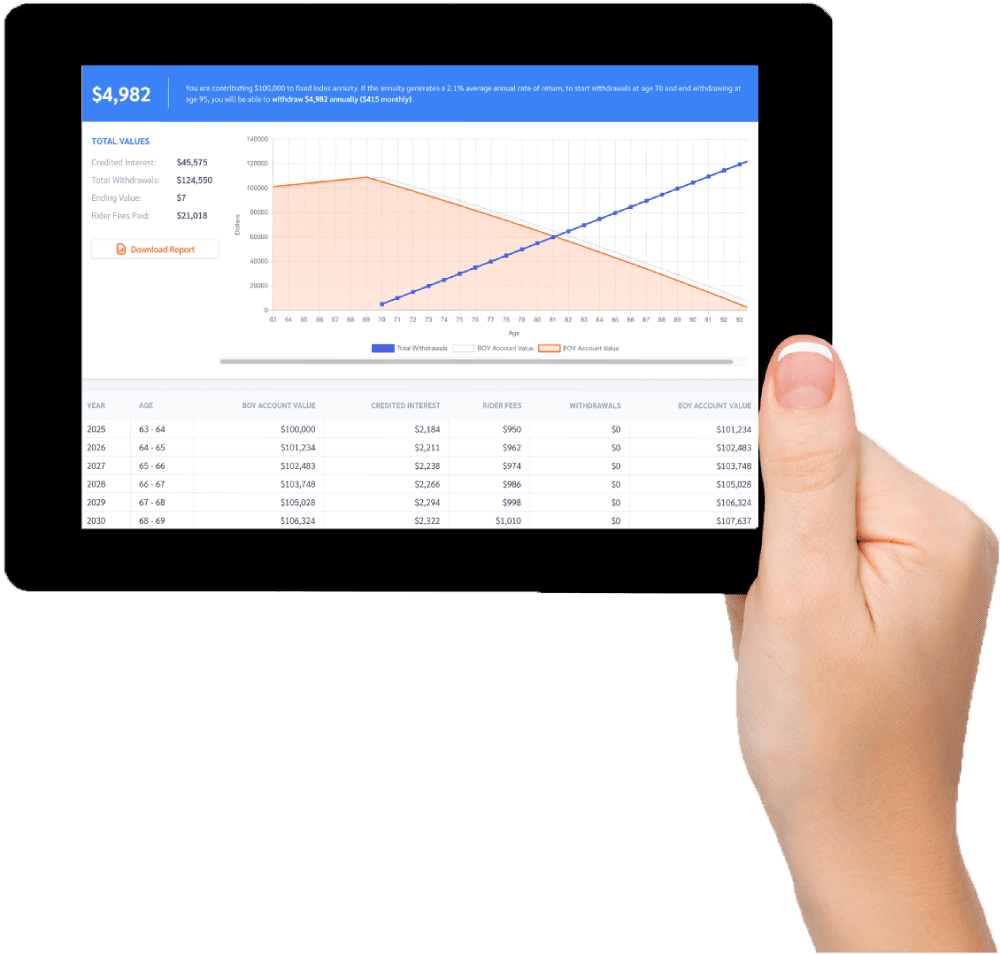

was explaining everything in plain English showing illustrations, graphs and tables. I made an educated decision

and put my money into flexible premium indexed annuities. Now I feel great, no matter what happens with the stock

market I would not suffer the devastating losses of 2008 crash again. My money is earning around 7% tax deferred

interest and I know I will be getting income for the rest of my life and my beneficiaries would get the residual

value of my annuity account. It is "win - win" situation. I highly recommend Annuity Educator, Inc. to all baby

boomers like myself and younger generation as well. Just do it for your own peace of mind.

After meeting with Annuity Educator, and having several more phone conversations, I realized that there was much

more to Annuities than I fully understood. He took the time to explain everything in detail, and then helped me

plan for a more structured retirement. I would recommend Annuity Educator if you have any questions about

annuities.

Annuity Educator did a great job guiding us through the process of getting our finances in order for retirement.

He explained everything so that we understood all of our options. He made the whole thing easy and enjoyable.

Great job Annuity Educator!

Dear Annuity Educator,

My wife and I were new to understanding annuities until we met Annuity Educator. All in all it was a complex

affair like everything else is in life until the process was thoroughly explained by Annuity Educator.

We vouch our reputations that Annuity Educator is fully qualified to orchestrate your money and give you his best

recommendation to suit your purpose. We invested the first portion of our assets and look forward to investing our

second round!

In Friendship,

Alex & Gerri

Upon approaching retirement, my wife and I began looking at several options for retirement investing. One scheme

we were attracted to were fixed indexed annuities (FIA) for part of our investment portfolio. Our primary

attraction to FIA was the protection from significant market downturns while still participating in some of the

up-side.

I spent several months researching many FIA alternatives, including 11 different programs from 8 different

broker/dealers.

One of my inquiries was to Annuity Educator. Annuity Educator was very quick to find a product offered by a highly

rated insurance company that meet our investment requirements. We bought two FIA policies through Annuity

Educator; one each for my wife and myself.

We have been very pleased with the level of knowledge, professionalism, and experience that we received from

Annuity Educator. We highly recommend his services.

Annuity Educator was immensely helpful in providing my wife and I with information regarding annuties in his

document entitled "The Secret Truth about Annuities". Annuity Educator's document explaining the various types of

annuties, the terms associated with annuities, how annuties work and most importantly, showing where an annuity is

benefical, was extremely enlightening and helpful. Annuity Educator's access to all the companies that sell

annuties and his ability to select the optimum annuity for our situation to provide the highest reliable payment

on our principle with a top rated company gave us the assurance that we got the best annuity to meet our needs.

Annuity Educator is very responsive, knowledgeable,and attentive. He did a great job financially planning my

future and he made the process seamless. He cares about his clients and always answers questions completely and

thoroughly.

Now a year after investing in Annuities with Annuity Educator my Wife and I are even more confident this was the

best decision for this portion of our portfolios. We fully endorse and will be purchasing through Annuity Educator

again!

Annuity Educator was such a pleasure to work with. He is a real professional and we will be doing more business

with him. He takes the time to explain everything thoroughly and to answer all of our questions. No pressure at

all. We are already receiving payments on our annuity.

For the first time found a guy who really knows the Annuity market and not stuck with rep ping one company, and

one product, but many and can computer-search the best one for you. As there are now so many choices in the

Annuity market and most CPA’s and accountant will tell you, they are not a good investment, they are so wrong, its

because they don’t get a cut on it. Check it out, I can not find a better, guaranteed return for life than what

Annuity Educator found for me. I just started with him, and we will see how he continues. but so far very happy.

Annuity Educator did a great job. He explained annuities clearly, made sense of them and answered all questions.

He made the process simple and was on time for appointments.

Annuity Educator is a great guy!

Annuity Educator helped me research annuities and eventually buy one. He and his staff were insightful, helpful,

and (perhaps most importantly) patient. I have recommended him to friends, and I expect to do so again.

Annuity Educator was most helpful in explaining the various retirement options. I recommend him to anyone who

wants to receive broad based information. Way to go, Annuity Educator!!!

Annuity Educator is very knowledgeable, works with only the top companies and can show you the most competitive

options based on your goals.

Annuity Educator did a great job in helping me get this annuity and let me invest my money with no risk in the

stock market.He explained everything in great details and was very helpful.

Annuity Educator is very knowledgeable and has an excellent Experience that help you and guide you to choose the

right Annuity with a maximum benefit

Annuity Educator was very professional, thoroughly reviewed all documents. Would highly recommend.

Great working with Annuity Educator; All that are considering an annuity should give him a call.

annuity educator

annuity educator