Secure Term MVA Fixed Annuity II (CA Only)

The Secure Term MVA Fixed Annuity II from New York Life offers a smart and secure way to ensure a steady retirement income. With an attractive initial interest rate determined by your premium payment, and a range of interest rate guarantee periods to choose from, it provides a tailored approach to match your needs. The lack of annual policy maintenance or administrative fees further sweetens the deal!

But what sets this product apart from similar offerings is its automatic addition of the Living Needs Benefit/Unemployment Rider. This rider provides flexibility during unexpected life setbacks, allowing withdrawals or full waiver of surrender charges during a qualifying event. As an added benefit, the Secure Term MVA Fixed Annuity II has an option for an Enhanced Beneficiary Benefit Rider, which can significantly offset tax obligations for your beneficiaries upon your death. As always, every product is backed by the financial strength of New York Life, one of the highest rated life insurers in the US.

Secure Term MVA Fixed Annuity II (CA Only)

About Product

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 3 years | 3.45% |

| 4 years | 3.5% |

| 5 years | 3.55% |

| 6 years | 3.65% |

| 7 years | 3.65% |

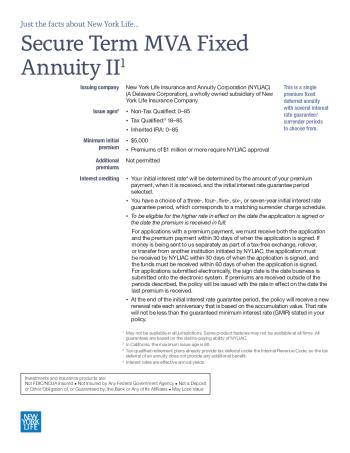

Premium

- Minimum initial premium is $5,000.

- Additional premiums are not permitted.

- Policies with premium amounts of $1 million or more require prior New York Life Insurance and Annuity Corporation approval.

The Free Look Period varies by state. Surrender charges are five, six or seven years in duration and are waived in the event of annuitization, death, disability, diagnosis of a terminal illness, unemployment, or entrance into a health care facility (a state licensed/certified assisted living facility or nursing home).

Withdrawal options

- Minimum withdrawal amount is $100. Surrender charges and a Market Value Adjustment (MVA) may apply.

- The policy accumulation value may not fall below $2,000 due to a partial withdrawal.

- Each policy year, you may withdraw the greatest of:

- 10% of the accumulation value as of the last policy anniversary, or

- 10% of the current accumulation value, or

- 100% of the gain earned in the policy. (For policies with a premium amount of $100,000 or more. Not available in New York.)

Market Value Adjustment (MVA)

The New York Life Secure Term MVA Fixed Annuity II comes with a Market Value Adjustment (MVA) provision that allows NYLIAC to offer a potentially higher initial interest rate than a product that does not offer this adjustment. An MVA only applies when the policy owner surrenders or makes a withdrawal from the contract that is greater than the surrender-charge-free withdrawal amount during the surrender charge period. An MVA is not applicable after the surrender charge period is over. The MVA will add or deduct an amount from your annuity, or from the withdrawal amount you receive. The amount of the MVA is determined by a formula that measures the change in the U.S. Treasury Constant Maturity yield, plus the applicable Bloomberg Barclays U.S. Corporate Bond Index from the issue date to the surrender or excess withdrawal date. If the interest rates on which the MVA is based are higher than when you purchased the annuity, the MVA will likely be negative, meaning an additional amount may be deducted from either your annuity or your withdrawal amount. Conversely, if the interest rates on which the MVA is based are lower than when you purchased your annuity, the MVA will likely be positive, meaning money may be added to either your annuity or to your withdrawal amount. The MVA cannot decrease the accumulation value of the policy below the premiums paid (less prior withdrawals and applicable charges and taxes) accumulated at the guaranteed minimum interest rate (GMIR) as stated in your contract. However, the applicable surrender charges may further reduce the accumulation value below the premium paid or the amount you receive when you make a partial withdrawal or fully surrender the policy.

There are two additional riders; the Enhanced Spousal Continuance Rider and the Enhanced Beneficiary Benefit Rider. These riders are not available in NY, NJ, or WA. Each rider may not be available in all jurisdictions. Some states may offer the rider under a different name and benefits may vary. Withdrawals and taxable distributions may be subject to ordinary income tax and if made prior to age 59 1/2, may also be subject to a 10% federal income tax penalty. Early surrender charges and an MVA may also apply. Guarantees based on claims paying ability of insurer. Products / features may not be available in all states. This is an annuity contract issued by an insurance company and not a bank product protected by the FDIC.

To qualify for the old New York Life Fixed Annuity rates, if rates decrease

Applications MUST be signed and dated prior to the date of change. Money and paperwork must be received at the lockbox no later than 30 days after the application signed date. For transfers/exchanges , applications MUST be signed and dated PRIOR to the date of change. Application and paperwork must be received at the Lockbox IN GOOD ORDER no later than 30 days from the application signed date. Money MUST be received at the Lockbox no later than 60 days from application signed date (part 1 for Reg. 60).

Paperwork MUST be signed and dated ON OR AFTER the date of change. Money and paperwork MUST be received in GOOD ORDER at the lockbox within 30 days of the application signed date. For transfers/exchanges , paperwork MUST be signed and dated ON OR AFTER the date of change. Paperwork MUST be received IN GOOD ORDER at the lockbox within 30 days of the application signed date. Money MUST be received at the lockbox no later than 60 days from application signed date (part 1 for Reg. 60).

Riders

| Name | Inbuilt | Fee |

|---|---|---|

| Enhanced Beneficiary Benefit Rider | Yes | 0.30% annually |

Waivers

Unemployment

The Living Needs Benefit/Unemployment Rider is automatically added to your policy with no additional fee. If you need immediate access to the money in your policy, this rider may give you some flexibility in accessing it, assuming you meet one of the following qualifying events: You are enrolled and living in a health care facility for 60 consecutive days; are diagnosed with a life expectancy of 12 months or less by a licensed physician; have a total and permanent disability that prevents you from performing any work for pay or profit for at least 12 consecutive months; or qualify for and have been receiving state unemployment benefits for 60 consecutive days. You may be eligible to make a withdrawal or receive the Accumulation Value with full or partial waiver of surrender charges, but in order to be eligible, the qualifying event must take place on or after the policy date, and the policy must be in force for at least one year prior to receiving any benefits. This rider is automatically added to all policies with an issue age of 85 and younger. There is a minimum cash value of $5,000 to be eligible to receive these benefits. Available in jurisdictions where approved and subject to eligibility requirements. Some states may offer the rider under a different name, and benefits may vary. Benefits do not apply if the policy is annuitized, and benefits are subject to the terms of the rider. Withdrawals may be taxable and, if taken prior to age 59½, may be subject to a 10% IRS penalty. For disability under this rider, withdrawals or full surrenders made on or after your 66th birthday are not eligible for this benefit — applicable surrender charges and MVA will apply. The MVA will not apply to withdrawals made under the Living Needs Benefit/Unemployment Rider or to required minimum distributions as calculated by NYLIAC. Home Health Care acceptable.

- A.M. Best A++

- Fitch AAA

- S&P AA+

- Moody's Aa1

- Comdex 100