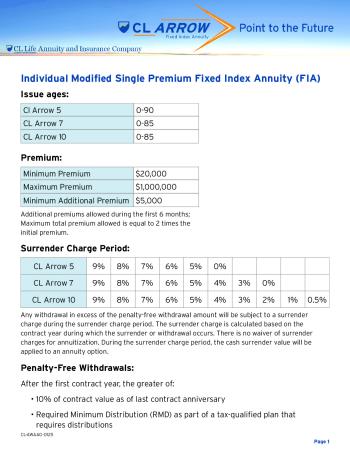

CL Arrow 5

CL Arrow 5

About Product

Allocation Accounts

| Name | Type | Rates |

|---|---|---|

| 1-Year Fixed Account |

Fixed

|

4.25%

Fixed

|

| 1-Year S&P 500 PTP Level-Lock Cap |

Point to Point

Annual

|

8%

Cap

|

| 1-Year Nasdaq-100 PTP Level-Lock Cap |

Point to Point

Annual

|

8%

Cap

|

| 1-Year MSCI USA PTP Level-Lock Cap |

Point to Point

Annual

|

8%

Cap

|

Surrender schedule

| Year | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Penalty | 9% | 8% | 7% | 6% | 5% |

Riders

No Riders for CL Arrow 5 annuity.

Waivers

Death

The MVA is waived whenever surrender charges are waived, this includes death benefit proceeds.

RMD

Beginning in the second policy year, you can make free partial withdrawals that qualify as the required minimum distribution (RMD) for this contract without incurring a surrender charge or MVA.

Premium Notes

Maximum: $1,000,000

Additional Premium Min: $5,000

Additional premiums allowed during the first 6 months; Maximum total premium allowed is equal to 2 times the initial premium.

Withdrawal Provisions

Surrender Charge Any withdrawal in excess of the penalty-free withdrawal amount will be subject to a surrender charge during the surrender charge period. The surrender charge is calculated based on the contract year during which the surrender or withdrawal occurs. There is no waiver of surrender charges for annuitization. During the surrender charge period, the cash surrender value will be applied to an annuity option. Penalty-Free WithdrawalsAfter the first contract year, the greater of: 10% of contract value as of last contract anniversary Required Minimum Distribution (RMD) as part of a tax-qualified plan that requires distributions MinimumsMinimum account balance after withdrawals/surrenders $2,000 Minimum withdrawal or surrender $100 Market Value Adjustment (MVA) A Market Value Adjustment will apply to any partial or full surrender that exceeds the maximum penalty-free withdrawal during the Surrender Charge Period. Depending on the direction that interest rates move, the MVA may increase or decrease the benefits under the contract. The MVA is waived whenever surrender charges are waived, this includes death benefit proceeds.

- A.M. Best B++

- Comdex 50

Other CL Life Products

Similar Products