SmartSelect

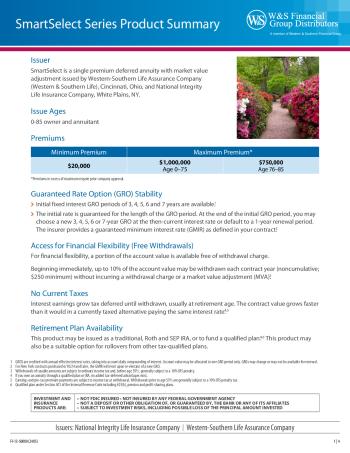

The SmartSelect annuity product, issued by the reputable Western-Southern Life Assurance Company, is a robust option for securing your financial future. It's an ideal way to invest a minimum of $20,000 with access to a steady stream of income during retirement. One of the product's strongest features is its Guaranteed Rate Option (GRO), allowing you to choose interest periods from 3 to 7 years with guaranteed rates. This feature provides secure and flexible investment choices that cater to varying time horizons.

Furthermore, SmartSelect offers annual free withdrawals of 10% of your account value without any associated charges, facilitating financial flexibility. The interest earnings on your investments grow tax-deferred, maximizing the growth of your wealth while reducing tax liabilities during your working years. Beneficiaries can also benefit from death benefit protection, ensuring that your loved ones are financially safeguarded. Overall, SmartSelect is an excellent annuity product for preparing a comfortable and worry-free retirement.

SmartSelect

About Product

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 3 years | 3.3% |

| 4 years | 3.5% |

| 5 years | 3.6% |

| 6 years | 3.35% |

| 7 years | 3.35% |

Guaranteed Rate Option (GRO) Stability

- Initial fixed interest GRO periods of 3, 4, 5, 6 and 7 years are available.

- The initial rate is guaranteed for the length of the GRO period. At the end of the initial GRO period, you may choose a new 3, 4, 5, 6 or 7-year GRO at the then-current interest rate or default to a 1-year renewal period. The insurer provides a guaranteed minimum interest rate (GMIR) as defined in your contract.

- Minimum Premium - $20,000

- Maximum Premium for age 18–75 - $1,000,000

- Maximum Premium for age 76–85 - $750,000

10 days or state-specific

Withdrawal Charge Waivers

Withdrawal charges and MVA may be waived for the following with prior notification:

- Limited life expectancy

- Confinement to a nursing home, hospital or licensed health care facility

- Required minimum distributions

- Guaranteed annuity options (full and partial)

For financial flexibility, a portion of the account value is available free of withdrawal charge. Beginning immediately, up to 10% of the account value may be withdrawn each contract year (noncumulative; $250 minimum) without incurring a withdrawal charge or a market value adjustment (MVA).

During a guarantee period of more than one year, which is called a Guaranteed Rate Option (GRO), an MVA applies to annuity options and withdrawals in excess of the free withdrawal amount. The MVA reflects the effect of the change in the interest rates we offer between the time the GRO was selected and the time the MVA is applied. Generally, if interest rates increase, the MVA reduces your contract’s value. On the other hand, if interest rates decrease, the MVA increases your contract’s value. The amount of any MVA will never be greater than the MVA Maximum, which is the difference, whether positive or negative, between:

- the current Account Value; and

- the Account Value applied at the beginning of the current GRO, minus withdrawals taken during the current GRO (including any withdrawal charge, but not considering any MVA), plus interest credited at the GMIR.

Riders

No Riders for SmartSelect annuity.

Waivers

Hospital

Unavailable in states: CA

Contact us to get more information about this waiver.

Nursing Home

Unavailable in states: CA

The nursing home waiver does not include home health care.

Terminal Illness

Unavailable in states: CA

Limited life expectancy waiver available if, after the contract date, the owner is diagnosed as having a life expectancy of 12 or fewer months.

Surrender Window

MVA does not apply during the last 30 days of the GRO.

Confinement

Unavailable in states: CA

Confinement to a nursing home, hospital or licensed health care facility. Confinement waiver available on or after the first contract anniversary after the owner is confined for at least 60 consecutive days.

- A.M. Best A+

- Fitch AA

- S&P AA-

- Moody's Aa3

- Comdex 95