120+ Annuity Resources

Answers to all your questions are right here

Popular Questions

Annuities are increasingly popular retirement planning products that offer a guaranteed and consistent income stream during your golden years. Among the various types of annuities available, non-quali...

Inheriting an annuity may come with a variety of complexities attached, especially when it comes to understanding its taxation process. This comprehensive guide will clarify the tax implications of in...

A tax-sheltered annuity, commonly referred to as a 403(b) plan, is an investment opportunity offering unique benefits and tax advantages for your retirement. The following article will explore this re...

As you plan for your financial future, understanding how annuities are taxed is essential in identifying whether such an investment is suitable for you. The following article will seek to address the...

The Internal Revenue Service allows you to replace your existing annuity or life insurance policy for a new one, insuring the same person, without paying tax on the investment gains earned on the orig...

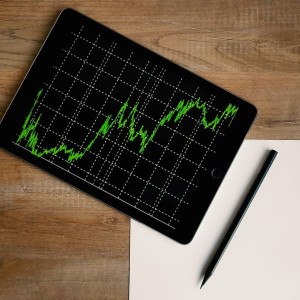

$100,000 Lump Sum Investment Grows to...5 Years10 Years15 Years20 Years25 Years3% Tax Deferred*11,59313,43915,58018,06120,9383% Taxed Annually**11,12812,38313,77915,33317,0624% Tax Deferred12,16714,80...

You might also be interested in

In order to have an ample understanding of annuities, it is essential to know how your inv...

How Does an Annuity Operate?Annuities are financial products issued by insurance companies...

Welcome to our comprehensive guide on qualified and non-qualified annuities, where we shal...