American Pathway NY SolutionsMYG

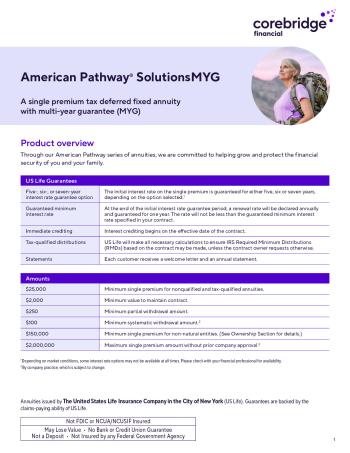

The American Pathway NY SolutionsMYG is the guardian angel for your post-retirement financial security! A single premium tax-deferred fixed annuity with a multi-year guarantee may sound technical but rest assured, it simply ensures steady growth of your investment. Plus, the initial interest rate is guaranteed for 5, 6, or 7 years depending on the option you choose, giving you control over your savings.

This annuity also offers immediate interest crediting, giving your investment a head start. There's a guaranteed minimum interest rate too! The cherry on top? The US Life will make necessary IRS Required Minimum Distributions. This is your ticket to a worry-free retirement! Plus, you can start with a minimum single premium of $10,000. Investing in American Pathway means a safe journey to a secure future.

American Pathway NY SolutionsMYG

About Product

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 5 years | 3% |

| 6 years | 4.15% |

| 7 years | 3.05% |

Penalty-free Withdrawal Privilege

After one year from the contract date, you may take multiple penalty-free withdrawals (without charges or MVA adjustments) each year not exceeding 15% of the previous anniversary contract value. No withdrawal charge or market value adjustment will be imposed on a full or partial withdrawal made within the 30-day period following the end of the initial guaranteed rate period. After the 30 -day window expires, withdrawal charges will resume for any withdrawal in excess of penalty-free amounts through the seventh year.

Market Value Adjustment (MVA)

The MVA is an adjustment that can either increase or decrease the withdrawal amount depending on the current interest rate environment. When interest rates at the time of the withdrawal are higher than the level at the time the contract is issued, the MVA will result in a decrease. If interest rates are down, the MVA will increase the withdrawal amount.

MVA does not apply to withdrawals representing penalty-free withdrawal amounts, RMDs, annuitization or death benefit. An external index referenced in your contract is used to measure rates.

After the initial rate term expires, the MVA no longer applies.

Potential Benefits of American Pathway SolutionsMYG Annuity

Guaranteed Rate Periods

Systematic Withdrawals

Systematic withdrawals are allowed at any time after contract issue by making a written election. $100 minimum amount monthly, quarterly, semiannually or annually. Systematic withdrawals may be subject to withdrawal charges.

Note: TSP funds have to be rolled into an IRA.

Riders

No Riders for American Pathway NY SolutionsMYG annuity.

Waivers

Death

Death Benefit available without withdrawal charge or MVA.

Terminal Illness

Withdrawal charges and any MVA decrease will be waived for one full or partial withdrawal if the owner is diagnosed with a terminal illness that is expected to result in death within one year.

Annuitization

Withdrawal Charge or MVA does not apply to annuitization.

Surrender Window

No withdrawal charge or market value adjustment will be imposed on a full or partial withdrawal made within the 30-day period following the end of the initial guaranteed rate period. After the 30-day window expires, withdrawal charges will resume for any withdrawal in excess of penalty-free amounts through the seventh year. Additionally, RMDs which are based solely on this contract may be taken at any time after contract issue without charges or MVA.

Extended Care

Withdrawal charges and any MVA decrease will be waived if the owner is confined to a qualifying institution or extended care facility for 90 consecutive days or longer beginning after the second contract year

- A.M. Best A

- Fitch A+

- S&P A+

- Moody's A2

- Comdex 80