American Pathway NY Fixed 7

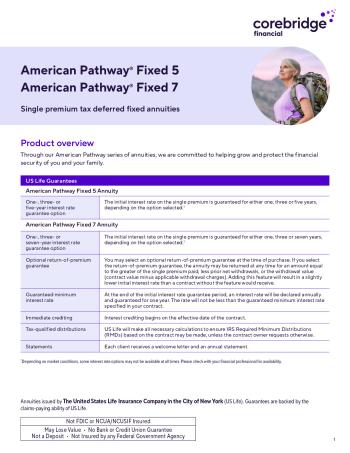

The American Pathway NY Fixed 7 annuity is a terrific investment choice for retirees, offering financial growth and security. It gives a guaranteed interest rate on your premium for one, three, or seven years, depending on your choice. Plus, it has an optional return-of-premium guarantee, providing peace of mind as you can return the annuity anytime for an amount equal to the premium paid.

Key benefits include immediate interest crediting, tax-qualified distributions, and a guaranteed minimum interest rate after the initial term. It also offers flexible premium options and withdrawal privileges. Best of all, it's backed by the reputable US Life, adding to the sense of reliability. The American Pathway NY Fixed 7 annuity is a solid vehicle for future-proofing your retirement.

American Pathway NY Fixed 7

About Product

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 7 years | 3.1% |

Traditional Fixed Annuity Interest Rates

| Surrender Years | First Year Yield | Term Guaranteed Yield | Term Current Yield |

|---|---|---|---|

| 7 | 3.85% | 3.41% | 4.14% |

| 7 | 4.5% | 3.64% | 4.5% |

Penalty-Free Withdrawal

Privilege After 30 days from the contract date, you may take multiple penalty-free withdrawals (without charges) each year not exceeding in total the greater of (1) the accumulated interest earned or (2) up to 15% of the previous anniversary contract value. If you do not use all of the 15% withdrawal percentage in a contract year, you may carry over the unused portion (up to 5%) to the next contract year increasing the annual withdrawal to 20% of the anniversary contract value (or the accumulated interest if greater).

Systematic Withdrawals

- Systematic withdrawals are allowed after 30 days by making a written election

- $100 minimum amount monthly, quarterly, semiannually or annually

- Systematic withdrawals may be subject to withdrawal charges if they exceed penalty-free withdrawal amounts

$250 minimum amount. US Life reserves the right to pay the entire withdrawal value and terminate the contract if a withdrawal reduces the contract value to less than $2,000.

More flexibility with optional return-of-premium guarantee

Both the American Pathway Fixed 5 and Fixed 7 annuities offer an optional return-of-premium guarantee at the time of purchase. Adding this feature will slightly lower your initial interest rate. With the return-of-premium guarantee option, if you cancel the annuity contract, you will always receive the greater of:

- Your single premium, less prior net withdrawals

- The withdrawal value (contract value minus applicable withdrawal charges)

Riders

No Riders for American Pathway NY Fixed 7 annuity.

Waivers

Death

Payable on death of owner. Equals the contract value ( without withdrawal charge). Joint owners must be each other's sole. | Spousal Beneficiaries - if the spouse is the sole beneficiary of a deceases owner, he/ she may elect to become the new "owner" or receive a distribution. | Non-Spousal Beneficiaries - Upon the death of any owner, the beneficiary may receive either annuity income beginning within one year or a total distribution within five years.

Terminal Illness

The owner must be initially diagnose with a terminal illness after the contract date, Only one partial or a full withdrawal is permitted.

Annuitization

Annuitization available with no withdrawal charge.

Extended Care

The owner must receive extended care for at least 90 consecutive days, beginning after the second contract year. The extended care may not have begun before the contract date.

- A.M. Best A

- Fitch A+

- S&P A+

- Moody's A2

- Comdex 80