SPDA Guaranteed Interest Rate

The SPDA Guaranteed Interest Rate annuity is an excellent choice for long-term financial planning. With its fixed interest rates and no additional premium contributions, it provides assurance and predictability for your future. One standout feature is the death benefits, providing peace of mind that your spouse can continue the policy if needed.

This annuity is consumer-friendly with no sales charges or fees, and a special provision that allows withdrawals free of surrender charges. These charges only apply when making more than a 10% withdrawal from the account value each year. With the flexibility and security offered, SPDA is definitely a winning choice in planning for retirement.

SPDA Guaranteed Interest Rate

About Product

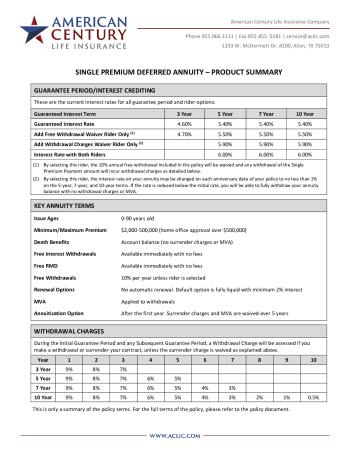

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 3 years | 4.1% |

| 5 years | 4.9% |

| 7 years | 4.9% |

| 10 years | 4.9% |

Death Benefits

Death Benefits are equal to the account value upon death of the owner.

If the owner's spouse is the sole beneficiary, the spouse may continue the policy in his or her own name.

No Sales Charges or Fees

There are no annual maintenance fees and no front-end sales loads.

Market Value Adjustment

When you make a withdrawal, we also may increase or decrease the amount you receive based on a market value adjustment (MVA). If interest rates went up after you bought your annuity, the MVA likely will decrease the amount you receive. If interest rates went down, the MVA will likely increase the amount you receive.

Exceptions to Surrender Charges & MVA

- You may withdraw 100% of your accumulated interest and RMD free of all charges at any time.

- You may withdraw 10% of the account value each year (including any accumulated interest amount) free of surrender charges. MVA calculation will apply. This exception may not apply if you selected the Free Withdrawal Waiver rider.

Riders

| Name | Inbuilt | Fee |

|---|---|---|

| SPDA Free Withdrawal Waiver Rider | No | |

| SPDA Withdrawal Charges Waiver Rider | No |

Waivers

Death

In the event of owner death, withdrawal charges and MVA are waived and benefits equal the account balance

Annuitization

You may elect to annuitize at any time after the first year from a number of options. Surrender charges and MVA are waived with a payout period of 5 years or longer

RMD

Available immediately with no fees

- A.M. Best B++