SPDA with Withdrawal Charges Waiver

The SPDA with Withdrawal Charges Waiver is an excellent choice for long-term planning. It offers a guaranteed rate that you get to select, promising suitable returns on your investment. Fantastic news for spouses! If the owner passes away, the surviving spouse can continue the policy. Plus, have peace of mind with no maintenance fees or sales charges.

What's exciting is the Market Value Adjustment, which adjusts your withdrawal amount based on interest rates. And yes, it could boost your payout when rates are down. The exceptions to Surrender Charges & MVA offers flexibility, and with the Withdrawal Charges Waiver, you're free to withdraw your balance potentially avoiding charges. This annuity sure has your future in mind!

SPDA with Withdrawal Charges Waiver

About Product

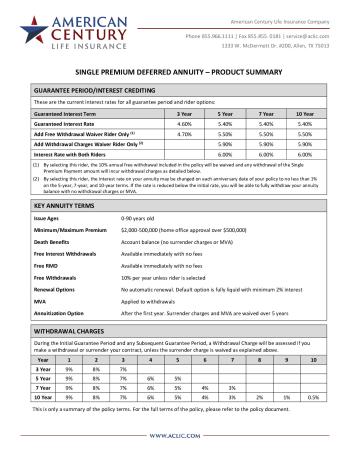

Traditional Fixed Annuity Interest Rates

| Surrender Years | First Year Yield | Term Guaranteed Yield | Term Current Yield |

|---|---|---|---|

| 5 | 5.7% | 2.74% | 5.7% |

Death Benefits

Death Benefits are equal to the account value upon death of the owner.

If the owner's spouse is the sole beneficiary, the spouse may continue the policy in his or her own name.

No Sales Charges or Fees

There are no annual maintenance fees and no front-end sales loads.

Market Value Adjustment

When you make a withdrawal, we also may increase or decrease the amount you receive based on a market value adjustment (MVA). If interest rates went up after you bought your annuity, the MVA likely will decrease the amount you receive. If interest rates went down, the MVA will likely increase the amount you receive.

Exceptions to Surrender Charges & MVA

- You may withdraw 100% of your accumulated interest and RMD free of all charges at any time.

- You may withdraw 10% of the account value each year (including any accumulated interest amount) free of surrender charges. MVA calculation will apply. This exception may not apply if you selected the Free Withdrawal Waiver rider.

By selecting this rider, the interest rate on your annuity may be changed on each anniversary date of your policy to no less than 1% on the 5-year, 7-year, and 10-year terms. If the rate is reduced below the initial rate, you will be able to fully withdraw your annuity balance with no withdrawal charges or MVA.

Riders

| Name | Inbuilt | Fee |

|---|---|---|

| SPDA Withdrawal Charges Waiver Rider | No |

Waivers

Bail-Out

The Policyowner has a Bail-Out option to get full withdrawal with no fees/MVA/surrender charges.

Death

In the event of owner death, withdrawal charges and MVA are waived and benefits equal the account balance

Annuitization

You may elect to annuitize at any time after the first year from a number of options. Surrender charges and MVA are waived with a payout period of 5 years or longer

RMD

Available immediately with no fees

- A.M. Best B++