based on complex data

Annuity Educator Rating

Annuity review

Heritage Elite 9

The Liberty Bankers Life Insurance Company, founded in 1958 under the name Royal Oak Life Insurance Company, has become a prominent provider of life insurance, annuity, and retirement planning solutions. With a particular focus on serving the final expense and wealth transfer markets, Liberty Bankers strives to deliver high-quality service and products that align with the specific needs of their clientele.

Heritage Elite 9

Your Email

!

About Product

Premium Type

Single Premium

Fee withdrawal:

None

Market Value Adjustment

Yes

Return Of Premium

No

Minimum Contribution

$10,000

Maximum Contribution

$1,000,000

Min Age Qualified

18

Max Age Qualified

86

Types Of Funds

Non-Qualified, Traditional IRA, SEP IRA, IRA-Roth, Inherited IRA, NQ Stretch, and Roth Conversion (Full)

Launch Date

10/28/2024

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 9 years | 5.5% |

Heritage Elite is a Single Premium Deferred Annuity Contract that provides multi-year interest rate guarantees. It is designed to accumulate money for retirement.

You can start your Heritage Elite annuity with a minimum premium of $10,000.

How Interest is Credited

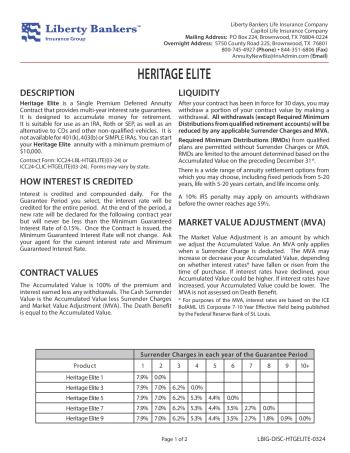

Interest is credited and compounded daily. For the Guarantee Period you select, the interest rate will be credited for the entire period. At the end of the period, a new rate will be declared for the following contract year but will never be less than the Minimum Guaranteed Interest Rate of 0.15%. Once the Contract is issued, the Minimum Guaranteed Interest Rate will not change. Ask your agent for the current interest rate and Minimum Guaranteed Interest Rate.

Contract Value

The Accumulated Value is 100% of the premium and interest earned less any withdrawals. The Cash Surrender Value is the Accumulated Value less Surrender Charges and Market Value Adjustment (MVA). The Death Benefit is equal to the Accumulated Value.

Liquidity

After your contract has been in force for 30 days, you may withdraw a portion of your contract value by making a withdrawal. All withdrawals (except Required Minimum Distributions from qualified retirement accounts) will be reduced by any applicable Surrender Charges and MVA.

Required Minimum Distributions (RMDs) from qualified plans are permitted without Surrender Charges or MVA. RMDs are limited to the amount determined based on the Accumulated Value on the preceding December 31st.

There is a wide range of annuity settlement options from which you may choose, including fixed periods from 5-20 years, life with 5-20 years certain, and life income only.

A 10% IRS penalty may apply on amounts withdrawn before the owner reaches age 59½.

Market Value Adjustment (MVA)

The Market Value Adjustment is an amount by which we adjust the Accumulated Value. An MVA only applies when a Surrender Charge is deducted. The MVA may increase or decrease your Accumulated Value, depending on whether interest rates* have fallen or risen from the time of purchase. If interest rates have declined, your Accumulated Value could be higher. If interest rates have increased, your Accumulated Value could be lower. The MVA is not assessed on Death Benefit.

* For purposes of the MVA, interest rates are based on the ICE BofAML US Corporate 7-10 Year Effective Yield being published by the Federal Reserve Bank of St. Louis.

You can start your Heritage Elite annuity with a minimum premium of $10,000.

How Interest is Credited

Interest is credited and compounded daily. For the Guarantee Period you select, the interest rate will be credited for the entire period. At the end of the period, a new rate will be declared for the following contract year but will never be less than the Minimum Guaranteed Interest Rate of 0.15%. Once the Contract is issued, the Minimum Guaranteed Interest Rate will not change. Ask your agent for the current interest rate and Minimum Guaranteed Interest Rate.

Contract Value

The Accumulated Value is 100% of the premium and interest earned less any withdrawals. The Cash Surrender Value is the Accumulated Value less Surrender Charges and Market Value Adjustment (MVA). The Death Benefit is equal to the Accumulated Value.

Liquidity

After your contract has been in force for 30 days, you may withdraw a portion of your contract value by making a withdrawal. All withdrawals (except Required Minimum Distributions from qualified retirement accounts) will be reduced by any applicable Surrender Charges and MVA.

Required Minimum Distributions (RMDs) from qualified plans are permitted without Surrender Charges or MVA. RMDs are limited to the amount determined based on the Accumulated Value on the preceding December 31st.

There is a wide range of annuity settlement options from which you may choose, including fixed periods from 5-20 years, life with 5-20 years certain, and life income only.

A 10% IRS penalty may apply on amounts withdrawn before the owner reaches age 59½.

Market Value Adjustment (MVA)

The Market Value Adjustment is an amount by which we adjust the Accumulated Value. An MVA only applies when a Surrender Charge is deducted. The MVA may increase or decrease your Accumulated Value, depending on whether interest rates* have fallen or risen from the time of purchase. If interest rates have declined, your Accumulated Value could be higher. If interest rates have increased, your Accumulated Value could be lower. The MVA is not assessed on Death Benefit.

* For purposes of the MVA, interest rates are based on the ICE BofAML US Corporate 7-10 Year Effective Yield being published by the Federal Reserve Bank of St. Louis.

Riders

No Riders for Heritage Elite 9 annuity.

Waivers

Death

The MVA is not assessed on Death Benefit.

Surrender Window

At the end of each Guarantee Period and prior to the Maturity Date, you may take a partial withdrawal with no Surrender Charge or MVA, and renew the remaining Accumulated Value into new Interest Rate Guarantee Period or Surrender the Contract with no Surrender Charge.

RMD

The product includes Penalty-Free Withdrawal Provisions for RMDs for qualified plans.

Company Founded: 1958

Excellent Rated

Company

Company Ratings

5

- A.M. Best A-

Assets: $2,683,229,471

Oklahoma