SecureOption Choice (CA Only)

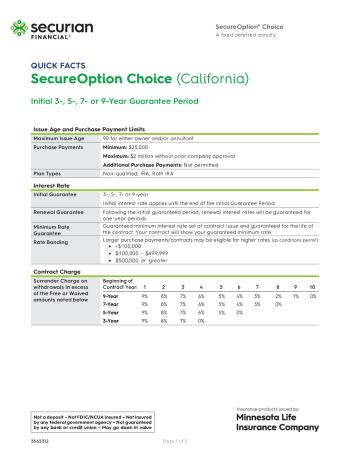

The SecureOption Choice annuity is a great choice for peace of mind in retirement. With this product, your interest is guaranteed and you won't have to worry about market risks. It also offers a lot of flexibility. Whether you choose a 3, 5, 7, or 9-year initial guarantee period, this plan comes with the reassurance of a guaranteed lifetime minimum interest rate of at least 1.00%.

What's more, if you need to make withdrawals beyond the free limit, the Market Value Adjustment feature can potentially increase your withdrawal amount. And, with the chance to convert to a steady income stream after the first year, SecureOption Choice is a reliable and secure choice for a worry-free retirement.

SecureOption Choice (CA Only)

About Product

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 3 years | 3.95% |

| 5 years | 4.15% |

| 7 years | 4.35% |

| 9 years | 4.55% |

Market Value Adjustment (MVA)

An adjustment applied upon withdrawal/surrender/annuitization to reflect changes in market conditions between contract issue and the date of withdrawal. An MVA can either increase or decrease the amount withdrawn from the annuity’s value. The MVA feature may not be applicable in all states,

- Applies only during the Surrender Charge Period on amounts in excess of the Free Withdrawal.

- A positive MVA will never exceed the amount of Surrender Charge assessed on the withdrawal or surrender.

Free Withdrawal (Amount not subject to Surrender Charge)

- 10% of prior contract anniversary value (not available in 1st contract year)

- RMD amount, if greater (all years)

Riders

No Riders for SecureOption Choice (CA Only) annuity.

Waivers

Death

Available

Hospital

Available after the 1st contract anniversary for the following qualifying events: 1) home care or community-based services, or 2) nursing facility care, or 3) residential facility care for at least 90 consecutive days.

Nursing Home

Available after the 1st contract anniversary for the following qualifying events: 1) home care or community-based services, or 2) nursing facility care, or 3) residential facility care for at least 90 consecutive days.

Terminal Illness

Available after the 1st contract anniversary for the following qualifying event: Terminal condition (life expectancy of 12 months or less).

Annuitization

Contact us to get more information about this waiver.

- A.M. Best A+

- Fitch AA

- S&P AA-

- Moody's Aa3

- Comdex 95