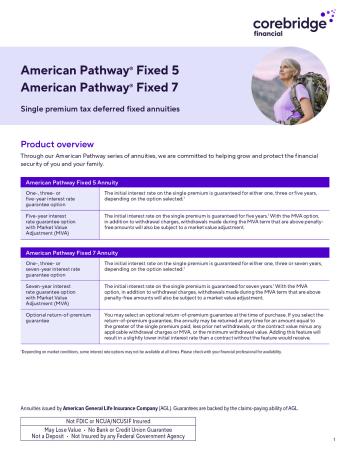

American Pathway Fixed 5

Are you planning for a secure financial future? The American Pathway Fixed 5 Annuity is designed to help you do just that. With single premium tax-deferred fixed annuities, and a guaranteed initial interest rate for one, three or five years, rest assured your finances are secure. Plus, their optional return-of-premium guarantee ensures you'll receive the great value of your annuity!

Another notable feature is the guaranteed minimum withdrawal value, ensuring you won't receive less than 87.5% of your premium, no matter how the market behaves. Moreover, interest crediting begins on the contract's effective date giving you immediate benefit! With a minimum single premium of just $5,000 for nonqualified annuities and $2,000 for tax-qualified ones, it's an affordable investment for your future.

American Pathway Fixed 5

About Product

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 5 years | 3.6% |

Traditional Fixed Annuity Interest Rates

| Surrender Years | First Year Yield | Term Guaranteed Yield | Term Current Yield |

|---|---|---|---|

| 5 | 4.8% | 3.28% | 4.8% |

| 5 | 3.85% | 1.67% | 3.95% |

Up to 15% free withdrawals each year

Access your money After 30 days from the contract date, you may take multiple free withdrawals each year, not exceeding in total the greater of the accumulated interest earned or up to 15% of the previous anniversary contract value.

If you don't need to use all of the 15% penalty-free withdrawal privilege percentage in a contract year, you may carry over the unused portion (up to 5%) to the next contract year, increasing the annual withdrawal to 20% of the anniversary contract value (or the accumulated interest if greater).

You can always withdraw more than the penalty-free amounts at any time. However, during the first five contract years of the American Pathway Fixed 5 and the first seven contract years of the American pathway Fixed annuities, the amount withdrawn over the penalty-free amounts will incur a withdrawal charge (and MVA if applicable), which can reduce the value of your contract. If you take a partial withdrawal, ensure your remaining contract value is at least $2,000. If the partial withdrawal reduces the contract value below $2,000 AGL reserves the right to pay the entire contract value and terminate the contract.

Systematic Withdrawals

Systematic withdrawals are allowed at any time after contract issue by making a written election. $100 minimum amount monthly, quarterly, semiannually or annually. Systematic withdrawals may be subject to withdrawal charges if they exceed penalty-free amounts.

Market Value Adjustment (MVA)

If you select the five-year or seven-year interest rate option with MVA, a market value adjustment applies to withdrawals taken during the initial interest rate guarantee period which exceed penalty-free amounts. The adjustment can either increase or decrease the withdrawal amount depending on the current interest rate environment.

When interest rates at the time of the withdrawal are higher than the level at the time the contract is issued, the MVA will result in a decrease. If interest rates are down, the MVA will increase the withdrawal amount.

Should an MVA decrease apply, the amount charged will not result in your receiving less than the minimum withdrawal value as defined in your contract. MVA does not apply to withdrawals representing penalty-free withdrawal amounts, RMDs, annuitization or death benefit. An external index referenced in your contract is used to measure rates.

More flexibility with optional return-of-premium guarantee

Both the American Pathway Fixed 5 and Fixed 7 annuities offer an optional return-of-premium guarantee at the time of purchase. Adding this feature will slightly lower your initial interest rate.

With the return-of-premium guarantee option, if you cancel the annuity contract, you will always receive the greater of:

- Your single premium less prior net withdrawals

- Contract value minus any applicable withdrawal charges or MVA

- The minimum withdrawal value

Riders

No Riders for American Pathway Fixed 5 annuity.

Waivers

Death

Death Benefit available without withdrawal charge or MVA.

Terminal Illness

Unavailable in states: CA

Withdrawal charges and MVA (if applicable) will be waived for one full or partial withdrawal if the owner is diagnosed with a terminal illness that is expected to result in death within one year. An initial diagnosis must be after the contract date and written documentation by a qualified physician is required. The Terminal Illness must be diagnosed by a Qualified Physician in writing supported by clinical, radiological, or laboratory evidence and must not have been diagnosed before the contract issue date.

Annuitization

Annuitization has no withdrawal charge or MVA.

Extended Care

Unavailable in states: CA

The owner must receive extended care for at least 90 consecutive days, beginning after the first contract year. The current extended care may not have started before the contract issue date. The rider terminates when the owner turns age 86.

RMD

RMDs which are based solely on this contract may be taken at any time after contract issue without charges or MVA.

- A.M. Best A

- Fitch A+

- S&P A+

- Moody's A2

- Comdex 80