American Pathway VisionMYG

Embrace a worry-free retirement with the American Pathway VisionMYG annuity, designed to bolster your financial security. Enjoy a decent interest rate guaranteed for four, five, six, seven or even up to 10 years. Imagine the peace of mind, knowing the return on your single premium is safeguarded and your wealth preserved.

On top of stability, you’ll appreciate the flexibility this annuity offers. Make penalty-free withdrawals, as needed, without stress. Your hard-earned investment includes a guarantee you will never receive less than 87.5% of your original premium. A trusting ally in your golden years, the American Pathway VisionMYG annuity ensures every sunset brings serenity, not financial stress.

American Pathway VisionMYG

About Product

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 4 years | 4.15% |

| 5 years | 3.85% |

| 6 years | 3.85% |

| 7 years | 3.9% |

| 10 years | 3.9% |

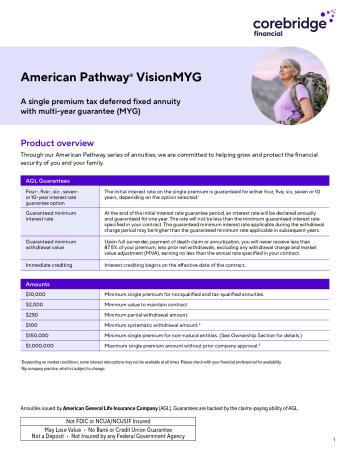

AGL Guarantees Four-, Five-, Six-, Seven- or 10-Year Interest Rate Guarantee Option

The initial interest rate on the single premium is guaranteed for either four, five, six, seven or 10 years, depending on the option selected. Depending on market conditions, some interest rate options may not be available at all times.

Penalty-free Withdrawal Privilege

After one year from the contract date, you may take multiple penalty-free withdrawals (without charges or MVA adjustments) each year not exceeding 15% of the previous anniversary contract value. Also, there is a 30-day window at the end of the initial interest rate guarantee period during which no withdrawal charge or market value adjustment will be imposed on a full or partial withdrawal. After the 30-day window expires, withdrawal charges will resume for any withdrawal in excess of penalty-free amounts.

Market Value Adjustment (MVA)

A market value adjustment applies during the initial rate term only. After the initial rate term, the MVA no longer applies, but the withdrawal charge continues for 10 years. The MVA is an adjustment that can either increase or decrease the withdrawal amount depending on the current interest rate environment. When interest rates at the time of withdrawal are higher than the level at the time the contract is issued, the MVA will result in a decrease. If interest rates are down, the MVA will increase the withdrawal amount. Should an MVA decrease apply, the amount charged will not result in your receiving less than the minimum withdrawal value as defined in your contract. MVA does not apply to withdrawals representing penalty-free withdrawal amounts, RM Ds, annuitization or death benefit. An external index referenced in your contract is used to measure rates.

Immediate Crediting

Interest crediting begins on the effective date of the contract.

Systematic Withdrawals

Systematic withdrawals are allowed at any time after contract issue by making a written election. $100 minimum amount monthly, quarterly, semiannually or annually. Systematic withdrawals may be subject to withdrawal charges.

Riders

No Riders for American Pathway VisionMYG annuity.

Waivers

Terminal Illness

Unavailable in states: CA

Withdrawal charges and MVA (if applicable) will be waived for one full or partial withdrawal if the owner is diagnosed with a terminal illness that is expected to a result in death within one year. Initial diagnosis must be after the contract date and written documentation by a qualified physician is required. The owner must be initially diagnosed with a terminal illness after the contract date. Only one partial or a full withdrawal is permitted. (May not be available in all states)

Surrender Window

There is a 30-day window at the end of the initial interest rate guarantee period during which no withdrawal charge or market value adjustment will be imposed on a full or partial withdrawal. After the 30-day window expires, withdrawal charges will resume for any withdrawal in excess of penalty-free amounts through the 10th year. Additionally, RMDs which are based solely on this contract may be taken at any time after contract issue without charges or MVA.

Extended Care

Unavailable in states: CA

Withdrawal charges and MVA (if applicable) will be waived if the owner is confined to a qualifying institution or extended care facility for 90 consecutive days or longer after the first contract year. We must receive proof within 90 days of the last day such extended care was received. Waiver does not apply if extended care began before the contract was issued. (May not be available in all states)

RMD

RMDs which are based solely on this contract may be taken at any time after contract issue without charges or MVA.

- A.M. Best A

- Fitch A+

- S&P A+

- Moody's A2

- Comdex 80