3-Year MYGA with 10% Free Withdrawal Rider

3-Year MYGA with 10% Free Withdrawal Rider

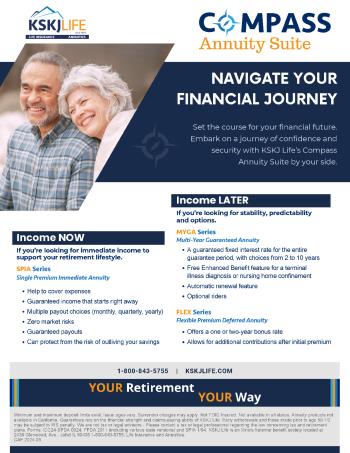

About Product

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 3 years | 4.15% |

The minimum deposit is $10,000.

Other than the Surrender Charge, KSKJ Life will not deduct fees, charges, or loading amounts from contributions or the Accumulated Fund Value either before or at the Maturity Date.

Penalty-free withdrawals are available through riders. These riders will result in a reduction of the crediting rate.

Penalty Free Withdrawal Rider

To submit an application for a KSKJ Life annuity, please contact KSKJ Life at 855-332-8809 or by [email protected]

Riders

| Name | Inbuilt | Fee |

|---|---|---|

| Penalty Free Withdrawal Rider | Yes |

Waivers

Death

Surrender Charge or MVA waived on death.

Nursing Home

Enhanced Benefit allows the owner to withdraw 50% of the value if the owner is confined to a Nursing home for 90 continuous days or more. There is no charge for this benefit.

Terminal Illness

Enhanced Benefit allows the owner to withdraw 50% of the value if the owner is diagnosed with a terminal illness. There is no charge for this benefit.

Annuitization

Surrender charges are not waived on annuitization/election of income option if within the surrender period.

Surrender Window

After the initial guarantee period, if an owner does not choose one of the options provided, the contract will automatically renew for another multi-year period of the same duration. Surrender charges and Market Value Adjustments will be waived within the first 30-days of the new multi-year guarantee period, but will apply after that 30-day period.

- A.M. Best -