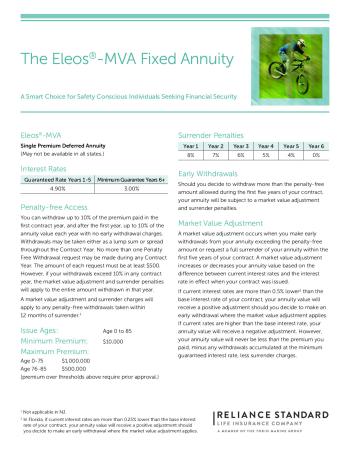

Eleos - MVA

The Eleos - MVA is a promising choice for those planning for retirement. This Single Premium Deferred Annuity is easy to start with a minimum initial contribution of $10,000 and guarantees an annual 10% free withdrawal of the paid premium. It also has a safety net feature where surrender charges are waived in times of a health crisis necessitating hospital or nursing home care.

Moreover, the Eleos - MVA offers great flexibility for accessing your money even before the maturity period, with up to 10% of your annuity value accessible yearly without surrender charges. If you're planning to grow your retirement funds while keeping them secure, the Eleos - MVA provides a welcoming balance of flexibility and security.

Eleos - MVA

About Product

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 5 years | 4.65% |

Minimum Premium:

- $10,000

- Age 0-75 - $1,000,000

- Age 76-85 - $500,000

Accessing Your Money Prior to Maturity

For maximum flexibility, you can access money in your annuity from the first day of your contract. You can withdraw up to 10% of your premium in the first year and 10% of your annuity value each year thereafter with no surrender charges. Withdrawals from your annuity, other than one of the Income Options shown on this page, will be considered to have been distributed from your interest earnings or amounts includible in income first and subject to ordinary income taxes and then a non-taxable return of principal. In addition, a 10% Federal penalty tax on the earnings may apply on withdrawals made before age 59-1/2.

Income Options

- Life annuity—A monthly income payable over the annuitant’s lifetime.

- Life annuity with payments certain—A monthly income payable over the annuitant’s lifetime with the additional guarantee that in the event of death prior to the end of the specified period (such as 5, 10 or as long as 20 years), payments will continue to your designated beneficiary for the remainder of the specified period.

- Designated period annuity—A monthly income payable in equal installments for a specified period (such as 5, 10 or as long as 20 years).

- Joint and last survivor annuity—A monthly income payable over the lifetime of an annuitant and thereafter during the lifetime of a designated surviving annuitant.

Your annuity contract’s death benefit is payable to your beneficiary upon your death. If you are also the annuitant, then your policy’s death benefit will be equal to the annuity’s value. If the annuitant is someone other than you, the policy’s death benefit is equal to the annuity value less any applicable surrender charges.

Market Value Adjustment

A market value adjustment occurs when you make early withdrawals from your annuity exceeding the penalty-free amount or request a full surrender of your annuity within the first five years of your contract. A market value adjustment increases or decreases your annuity value based on the difference between current interest rates and the interest rate in effect when your contract was issued. If current interest rates are more than 0.5% lower than the base interest rate of your contract, your annuity value will receive a positive adjustment should you decide to make an early withdrawal where the market value adjustment applies. If current rates are higher than the base interest rate, your annuity value will receive a negative adjustment. However, your annuity value will never be less than the premium you paid, minus any withdrawals accumulated at the minimum guaranteed interest rate, less surrender charges.

No return of premium feature

Riders

No Riders for Eleos - MVA annuity.

Waivers

Hospital

Unavailable in states: MA

Hospital Waiver: After policy year one, 90 day elimination period, up to 25% of the annuity value can be withdrawn in each contract year of qualified confinement. Annuitant must be 74 or younger at policy issue.

Nursing Home

Unavailable in states: MA

After policy year one, 90 day elimination period, up to 25% of the annuity value can be withdrawn in each contract year of qualified confinement. Annuitant must be 74 or younger at policy issue. The nursing home waiver does not include home health care.

ADL

Unavailable in states: AL, AK, AZ, AR, CA, CO, CT, DE, DC, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VT, VI, VA, WA, WV, WI, and WY

Chronic Illness (for Massachusetts only) To access your funds if you are totally and permanently disabled due to a chronic illness: • A Licensed Health Care Practioner must certify that for a period of at least 90 consecutive days you are unable to perform at least 2 Activities of Daily Living or have a similar level of disability, or require substantial supervision due to severe cognitive impairment. • Have been age 74 or younger when your contract was issued. If you are the annuitant and meet both conditions, you may withdraw up to 25% of your annuity value penalty-free in each year that you are totally and permanently disabled due to a chronic illness

- A.M. Best A++

- S&P A+

- Moody's A1

- Comdex 91