Apollo - MVA (Most States)

The Apollo-MVA annuity offers retirees and future planners a safe and smart choice. With guaranteed tax-deferred growth and lifetime income, this is an excellent product for those seeking financial security. Contribute to this annuity worry-free, knowing that your retirement savings are protected with a guaranteed rate of return. You can even roll over lump-sum payments from your company-sponsored retirement or pension plan.

Choosing Apollo-MVA gets you predictable, guaranteed income as well as tax deferment until you start making withdrawals. With stability of principal, it ensures your annuity won't lose value as long as you avoid prematurely withdrawing your annuity. Reliance Standard offers competitive rates, ensuring a steady growth of your investment over time. Plan for a comfortable retirement with the Apollo-MVA fixed annuity.

Apollo - MVA (Most States)

About Product

Traditional Fixed Annuity Interest Rates

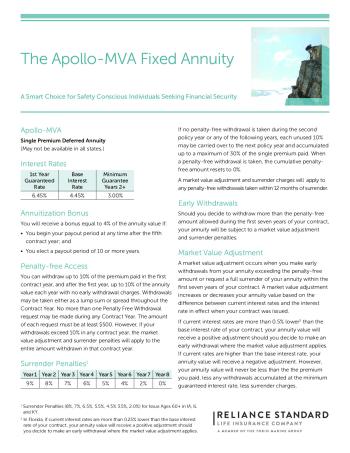

| Surrender Years | First Year Yield | Term Guaranteed Yield | Term Current Yield |

|---|---|---|---|

| 7 | 6.4% | 3.49% | 4.69% |

Minimum Premium:

- $5,000

- Age 0-75 - $1,000,000

- Age 76-85 - $500,000

Income Options

- Life annuity—A monthly income payable over the annuitant’s lifetime.

- Life annuity with payments certain—A monthly income payable over the annuitant’s lifetime with the additional guarantee that in the event of death prior to the end of the specified period (such as 5, 10 or as long as 20 years), payments will continue to your designated beneficiary for the remainder of the specified period.

- Designated period annuity—A monthly income payable in equal installments for a specified period (such as 5, 10 or as long as 20 years).

- Joint and last survivor annuity—A monthly income payable over the lifetime of an annuitant and thereafter during the lifetime of a designated surviving annuitant.

Death Benefit

Your annuity contract’s death benefit is payable to your beneficiary upon your death. If you are also the annuitant, then your policy’s death benefit will be equal to the annuity’s value. If the annuitant is someone other than you, the policy’s death benefit is equal to the annuity value less any applicable surrender charges.

During the first 12 months of your contract, you can withdraw up to 10% of the single premium paid penalty-free, and, in any contract year thereafter, up to 10% of the annuity value penalty-free. If you should withdraw more than the penalty-free amount in any contract year, the entire amount withdrawn during that contract year is subject to the applicable MVA and surrender charges.

Cumulative Withdrawal Benefit

If no penalty-free withdrawal is taken in contract year two or any contract year thereafter, the amount of that contract years penalty-free withdrawal may be carried over into the following year. If no withdrawals are made for one or more successive years, the penalty-free withdrawal will accumulate up to a maximum penalty-free withdrawal limit of 30% of the single premium paid. Any penalty-free withdrawal carry over balance will return to zero as soon as a penalty free withdrawal of any amount is taken.

Riders

No Riders for Apollo - MVA (Most States) annuity.

Waivers

Hospital

The event of hospitalization or nursing home confinement, an annuity rider gives you an increased level of penalty-free access to the annuity value as follows: If the annuitant is admitted to a qualified nursing care facility (as defined in the contract) following the end of the first Contract Year and remains in such facility for ninety consecutive days, up to 25% of the annuity value may be withdrawn without penalty in each Contract Year so long as the annuitant remains in such facility. This rider is only available when the annuitant’s age at the issuance of the annuity contract would be 74 or younger and continues until the contract terminates.

Nursing Home

The event of hospitalization or nursing home confinement, an annuity rider gives you an increased level of penalty-free access to the annuity value as follows: If the annuitant is admitted to a qualified nursing care facility (as defined in the contract) following the end of the first Contract Year and remains in such facility for ninety consecutive days, up to 25% of the annuity value may be withdrawn without penalty in each Contract Year so long as the annuitant remains in such facility. This rider is only available when the annuitant’s age at the issuance of the annuity contract would be 74 or younger and continues until the contract terminates. The nursing home waiver does not include home health care.

Annuitization

After 5th policy year with an option lasting at least 6 years.

- A.M. Best A++

- S&P A+

- Moody's A1

- Comdex 91