Reliance Guarantee 10

The Reliance Guarantee 10 is a fixed annuity aimed at securing your financial future for a more comfortable retirement. Offering guaranteed returns and tax-deferred growth, this product ensures your principal amount is safe and provides lifetime income. It's the perfect choice for anyone seeking to protect their retirement savings, rollover a large pension lump-sum or enhance their IRA contributions.

Reliance Standard has been a trusted provider for over 100 years and this annuity product further emphasizes their commitment to financial stability. The major benefits include guaranteed growth with a minimum interest rate, stability of principal, tax deferral on earnings and guaranteed lifetime income. If you're seeking predictable income, peace of mind and a financially secure future, the Reliance Guarantee 10 fits the bill perfectly!

Reliance Guarantee 10

About Product

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 10 years | 4.95% |

Issue ages: Age 0 to 85

Minimum premium: $20,000

Maximum premium:

Age 0-75 - $1,000,000

Age 76-85 - $500,000

(Premium over thresholds above require prior approval)

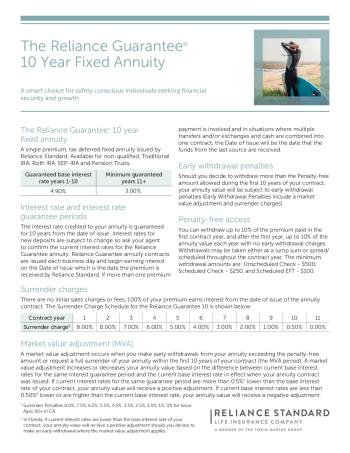

Interest rate and interest rate guarantee periods

The interest rate credited to your annuity is guaranteed for 5, 7, and 10 years from the date of issue. Interest rates for new deposits are subject to change so ask your agent to confirm the current interest rates for the Reliance Guarantee annuity. Reliance Guarantee annuity contracts are issued each business day and begin earning interest on the Date of Issue which is the date the premium is received by Reliance Standard. If more than one premium payment is involved and in situations where multiple transfers and/or exchanges and cash are combined into one contract, the Date of Issue will be the date that the funds from the last source are received.

Penalty-free access

You can withdraw up to 10% of the premium paid in the first contract year, and after the first year, up to 10% of the annuity value each year with no early withdrawal charges. Withdrawals may be taken either as a lump sum or spread/ scheduled throughout the contract year. The minimum withdrawal amounts are: Unscheduled Check - $500, Scheduled Check - $250, and Scheduled EFT - $100.

Market Value Adjustment

Market value adjustment (MVA) A market value adjustment occurs when you make early withdrawals from your annuity exceeding the penalty-free amount or request a full surrender of your annuity within the first 5 years of your contract (the MVA period). A market value adjustment increases or decreases your annuity value based on the difference between current base interest rates for the same interest guarantee period and the current base interest rate in effect when your annuity contract was issued. If current interest rates for the same guarantee period are more than 0.5% lower than the base interest rate of your contract, your annuity value will receive a positive adjustment. If current base interest rates are less than 0.50% lower or are higher than the current base interest rate, your annuity value will receive a negative adjustment. However, your annuity value will never be less than the premium you paid, less any withdrawals, accumulated at the minimum guaranteed interest rate, less surrender charges.

Death Benefit

Your annuity contract’s death benefit is payable to your beneficiary upon your death. If you are also the annuitant, then your policy’s death benefit will be equal to the annuity’s value. If the annuitant is someone other than you, the policy’s death benefit is equal to the annuity value less any applicable surrender charges.

Income Options

- Life annuity—A monthly income payable over the annuitant’s lifetime.

- Life annuity with payments certain—A monthly income payable over the annuitant’s lifetime with the additional guarantee that in the event of death prior to the end of the specified period (such as 5, 10 or as long as 20 years), payments will continue to your designated beneficiary for the remainder of the specified period.

- Designated period annuity—A monthly income payable in equal installments for a specified period (such as 5, 10 or as long as 20 years).

- Joint and last survivor annuity—A monthly income payable over the lifetime of an annuitant and thereafter during the lifetime of a designated surviving annuitant.

Riders

No Riders for Reliance Guarantee 10 annuity.

Waivers

Nursing Home

To provide liquidity in the event funds are needed due to a health issue, you may access up to 25% of your annuity value penalty free when the annuitant or any joint annuitant is: 1. Admitted to a qualified nursing facility for at least one day following the end of the first contract year 2. Confined to the facility for 90 consecutive days, and 3. Both the annuitant and any joint annuitant were age 74 or younger on the Date of Issue. The nursing home waiver does not include home health care.

- A.M. Best A++

- S&P A+

- Moody's A1

- Comdex 91