Eleos - SP

The Eleos-SP Fixed Annuity from Reliance Standard Life Insurance Company offers a smart and safe choice for individuals seeking for financial security. Ideal for those preparing for retirement or already in retirement, it presents a brilliant way to secure a guaranteed return on your retirement income. It's especially comforting to know that your annuity won't lose its value, providing an added layer of protection for your principle.

In case you need to rollover a lump sum from a retirement or pension plan, or you've maxed out your IRA contributions, Eleos-SP is a great fall back. It promises continued growth of your resources over time as interest accumulates on earnings you would have otherwise paid in income taxes! Plus, the guaranteed lifetime income is simply reassuring. Protect your future with Eleos-SP Fixed Annuity!

Eleos - SP

About Product

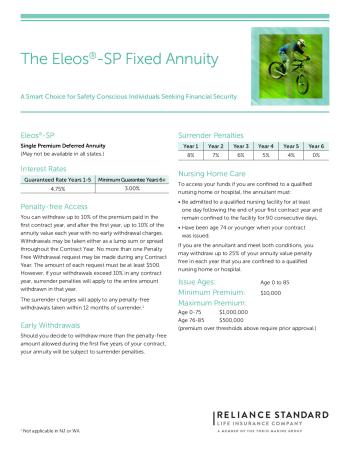

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 5 years | 4.5% |

Minimum Premium:

- $10,000

- Age 0-75 - $1,000,000

- Age 76-85 - $500,000

Accessing Your Money Prior to Maturity

For maximum flexibility, you can access money in your annuity from the first day of your contract. You can withdraw up to 10% of your premium in the first year and 10% of your annuity value each year thereafter with no surrender charges. Withdrawals from your annuity, other than one of the Income Options shown on this page, will be considered to have been distributed from your interest earnings or amounts includible in income first and subject to ordinary income taxes and then a non-taxable return of principal. In addition, a 10% Federal penalty tax on the earnings may apply on withdrawals made before age 59-1/2.

Income Options

- Life annuity—A monthly income payable over the annuitant’s lifetime.

- Life annuity with payments certain—A monthly income payable over the annuitant’s lifetime with the additional guarantee that in the event of death prior to the end of the specified period (such as 5, 10 or as long as 20 years), payments will continue to your designated beneficiary for the remainder of the specified period.

- Designated period annuity—A monthly income payable in equal installments for a specified period (such as 5, 10 or as long as 20 years).

- Joint and last survivor annuity—A monthly income payable over the lifetime of an annuitant and thereafter during the lifetime of a designated surviving annuitant.

Your annuity contract’s death benefit is payable to your beneficiary upon your death. If you are also the annuitant, then your policy’s death benefit will be equal to the annuity’s value. If the annuitant is someone other than you, the policy’s death benefit is equal to the annuity value less any applicable surrender charges.

Riders

No Riders for Eleos - SP annuity.

Waivers

Hospital

Unavailable in states: MA

Hospital Waiver: After policy year one, 90 day elimination period, up to 25% of the annuity value can be withdrawn in each contract year of qualified confinement. Annuitant must be 74 or younger at policy issue.

Nursing Home

Unavailable in states: MA

Nursing Home Waiver: After policy year one, 90 day elimination period, up to 25% of the annuity value can be withdrawn in each contract year of qualified confinement. Annuitant must be 74 or younger at policy issue. The nursing home waiver does not include home health care.

ADL

Unavailable in states: AL, AK, AZ, AR, CA, CO, CT, DE, DC, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NY, NC, ND, OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VT, VI, VA, WA, WV, WI, and WY

Chronic Illness (for Massachusetts only) To access your funds if you are totally and permanently disabled due to a chronic illness: • A Licensed Health Care Practioner must certify that for a period of at least 90 consecutive days you are unable to perform at least 2 Activities of Daily Living or have a similar level of disability, or require substantial supervision due to severe cognitive impairment. • Have been age 74 or younger when your contract was issued. If you are the annuitant and meet both conditions, you may withdraw up to 25% of your annuity value penalty-free in each year that you are totally and permanently disabled due to a chronic illness

- A.M. Best A++

- S&P A+

- Moody's A1

- Comdex 91