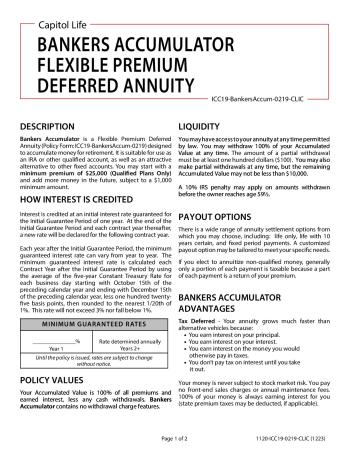

Bankers Accumulator

The Bankers Accumulator is a fantastic choice for those looking to build a safe and secure nest egg for retirement. With a minimum initial premium of $25,000 and the opportunity to add more money in the future, it's a flexible and accommodating option for long-term financial planning. Plus, the attractive interest rates, guaranteed for a year and adjusted annually thereafter, ensure your investment will grow steadily overtime.

One of its standout features is the robust liquidity it provides. You are in control and can access your invested money as needed, which provides great peace of mind. Pair that with varied payout options that can be customized to meet your specific needs, and the Bankers Accumulator emerges as a comprehensive and user-friendly annuity solution for all your retirement needs.

Bankers Accumulator

About Product

Traditional Fixed Annuity Interest Rates

| Surrender Years | First Year Yield | Term Guaranteed Yield | Term Current Yield |

|---|---|---|---|

| 0 | 3% | 3% | 3% |

Interest is credited at an initial interest rate guaranteed for the Initial Guarantee Period of one year. At the end of the Initial Guarantee Period and each contract year thereafter, a new rate will be declared for the following contract year.

Liquidity

You may have access to your annuity at any time permitted by law. You may withdraw 100% of your Accumulated Value at any time. The amount of a partial withdrawal must be at least one hundred dollars ($100). You may also make partial withdrawals at any time, but the remaining Accumulated Value may not be less than $10,000.

A 10% IRS penalty may apply on amounts withdrawn before the owner reaches age 59½.

Market Value Adjustment (MVA)

Upon a full surrender or a partial withdrawal in excess of any penalty-free amount, the Company will apply a Market Value Adjustment to the Accumulated Value. The Accumulated Value is adjusted either up or down based on (1) the difference between an external index when the premium was received and the index at the time of the withdrawal and (2) the time remaining to the end of the initial guarantee period shown above. The external index used is the Treasury Constant Maturity Series published by the Federal Reserve for the same duration as the length of time that Surrender Charges apply (see below). A Market Value Adjustment will not apply after the initial guarantee period nor will be ever cause the Cash Surrender Value to be less than the minimum values required by the Standard Nonforfeiture Law for Deferred Annuities as defined by applicable state insurance law.

Payout Options

There is a wide range of annuity settlement options from which you may choose, including: life only, life with 10 years certain, and fixed period payments. A customized payout option may be tailored to meet your specific needs. If you elect to annuitize non-qualified money, generally only a portion of each payment is taxable because a part of each payment is a return of your premium.

Riders

No Riders for Bankers Accumulator annuity.

Waivers

No Waivers for Bankers Accumulator annuity.

- A.M. Best A-