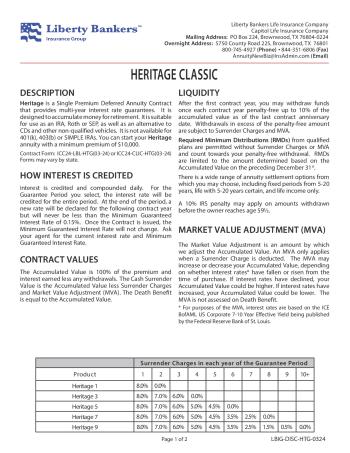

Heritage Classic 3

Heritage Classic 3

About Product

MYGA Interest Rates

| Term |

Rate

Annual percentage yield (APY)

earned over the investment term |

|---|---|

| 3 years | 4.6% |

How Interest is Credited

Interest is credited and compounded daily. For the Guarantee Period you select, the interest rate will be credited for the entire period. At the end of the period, a new rate will be declared for the following contract year but will never be less than the Minimum Guaranteed Interest Rate of 0.15%. Once the Contract is issued, the Minimum Guaranteed Interest Rate will not change. Ask your agent for the current interest rate and Minimum Guaranteed Interest Rate.

Contract Value

The Accumulated Value is 100% of the premium and interest earned less any withdrawals. The Cash Surrender Value is the Accumulated Value less Surrender Charges and Market Value Adjustment (MVA). The Death Benefit is equal to the Accumulated Value.

Liquidity

After the first contract year, you may withdraw funds once each contract year penalty-free up to 10% of the accumulated value as of the last contract anniversary date. Withdrawals in excess of the penalty-free amount are subject to Surrender Charges and MVA.

Required Minimum Distributions (RMDs) from qualified plans are permitted without Surrender Charges or MVA and count towards your penalty-free withdrawal. RMDs are limited to the amount determined based on the Accumulated Value on the preceding December 31st.

There is a wide range of annuity settlement options from which you may choose, including fixed periods from 5-20 years, life with 5-20 years certain, and life income only.

A 10% IRS penalty may apply on amounts withdrawn before the owner reaches age 59½.

Market Value Adjustment (MVA)

The Market Value Adjustment is an amount by which we adjust the Accumulated Value. An MVA only applies when a Surrender Charge is deducted. The MVA may increase or decrease your Accumulated Value, depending on whether interest rates* have fallen or risen from the time of purchase. If interest rates have declined, your Accumulated Value could be higher. If interest rates have increased, your Accumulated Value could be lower. The MVA is not assessed on Death Benefit.

* For purposes of the MVA, interest rates are based on the ICE BofAML US Corporate 7-10 Year Effective Yield being published by the Federal Reserve Bank of St. Louis.

Riders

No Riders for Heritage Classic 3 annuity.

Waivers

Death

The MVA is not assessed on Death Benefits.

Nursing Home

You may make a one-time Penalty-Free Withdrawal of up to 10% (1st year) or up to 50% (2nd year or later) of your Accumulated Value if you are diagnosed with a covered impairment or treatment. This benefit is automatically added to the contract and is subject to all applicable terms of the contract. A signed statement from the Skilled Nursing Facility providing evidence of 90-day confinement is required.

Terminal Illness

You may make a one-time Penalty-Free Withdrawal of up to 10% (1st year) or up to 50% (2nd year or later) of your Accumulated Value if you are diagnosed with a covered impairment or treatment. This benefit is automatically added to the contract and is subject to all applicable terms of the contract. A signed statement from the physician providing evidence of diagnosis is required.

Surrender Window

At the end of each Guarantee Period and prior to the Maturity Date, you may take a partial withdrawal with no Surrender Charge or MVA, and renew the remaining Accumulated Value into new Interest Rate Guarantee Period or Surrender the Contract with no Surrender Charge.

Disability

You may make a one-time Penalty-Free Withdrawal of up to 10% (1st year) or up to 50% (2nd year or later) of your Accumulated Value if you are diagnosed with a covered impairment or treatment. This benefit is automatically added to the contract and is subject to all applicable terms of the contract. 1. A signed statement from the physician providing evidence of 90-day disability is required, or 2. Proof of disability income from an insurance policy, from an employer’s benefit program, or from a governmental agency is required.

ADL

You may make a one-time Penalty-Free Withdrawal of up to 10% (1st year) or up to 50% (2nd year or later) of your Accumulated Value if you are diagnosed with a covered impairment or treatment. This benefit is automatically added to the contract and is subject to all applicable terms of the contract. A signed statement from the physician providing evidence annuitant is unable to perform 2 of the 6 Activities of Daily Living (ADL) required, limitations are not temporary, and have existed for at least 90 consecutive days.

- A.M. Best A-