based on complex data

Annuity Educator Rating

Annuity review

Heritage Accumulator

The Capitol Life Insurance Company, a subsidiary of the Liberty Bankers Group and founded in 1905, offers life insurance, annuities, and Medicare supplement plans. With a focus on bringing financial security to its policyholders, the company is committed to providing affordable insurance solutions, particularly targeting retirees and encompassing features like a 30-day trial policy and one-year rate locks. Capitol Life has become renown for its Medicare supplement products, which cover medical expenses that are typically not provided for by traditional Medicare policies.

Heritage Accumulator

Your Email

!

About Product

Premium Type

Flexible Premium

Fee withdrawal:

100%

Market Value Adjustment

No

Return Of Premium

No

Minimum Contribution

$25,000

Maximum Contribution

$1,000,000

Min Age Qualified

18

Max Age Qualified

100

Types Of Funds

Non-Qualified, Traditional IRA, SEP IRA, IRA-Roth, Inherited IRA, NQ Stretch, and Roth Conversion (Full)

Launch Date

10/28/2024

Traditional Fixed Annuity Interest Rates

| Surrender Years | First Year Yield | Term Guaranteed Yield | Term Current Yield |

|---|---|---|---|

| 0 | 2.25% | 0% | 0% |

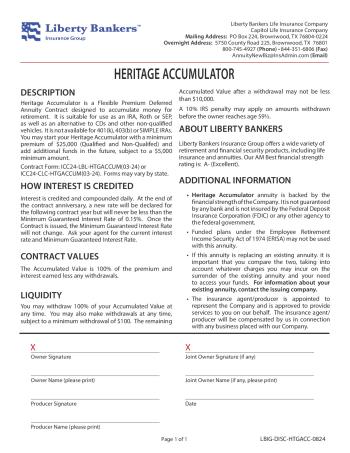

Heritage Accumulator is a Flexible Premium Deferred Annuity Contract designed to accumulate money for retirement. You may start your Heritage Accumulator with a minimum premium of $25,000 (Qualified and Non-Qualifed) and add additional funds in the future, subject to a $5,000 minimum amount.

How Interest is Credited

Interest is credited and compounded daily. At the end of the contract anniversary, a new rate will be declared for the following contract year but will never be less than the Minimum Guaranteed Interest Rate of 0.15%. Once the Contract is issued, the Minimum Guaranteed Interest Rate will not change. Ask your agent for the current interest rate and Minimum Guaranteed Interest Rate.

Contract Values

The Accumulated Value is 100% of the premium and interest earned less any withdrawals.

Liquidity

You may withdraw 100% of your Accumulated Value at any time. You may also make withdrawals at any time, subject to a minimum withdrawal of $100. The remaining Accumulated Value after a withdrawal may not be less than $10,000.

A 10% IRS penalty may apply on amounts withdrawn before the owner reaches age 59½.

How Interest is Credited

Interest is credited and compounded daily. At the end of the contract anniversary, a new rate will be declared for the following contract year but will never be less than the Minimum Guaranteed Interest Rate of 0.15%. Once the Contract is issued, the Minimum Guaranteed Interest Rate will not change. Ask your agent for the current interest rate and Minimum Guaranteed Interest Rate.

Contract Values

The Accumulated Value is 100% of the premium and interest earned less any withdrawals.

Liquidity

You may withdraw 100% of your Accumulated Value at any time. You may also make withdrawals at any time, subject to a minimum withdrawal of $100. The remaining Accumulated Value after a withdrawal may not be less than $10,000.

A 10% IRS penalty may apply on amounts withdrawn before the owner reaches age 59½.

Riders

No Riders for Heritage Accumulator annuity.

Waivers

No Waivers for Heritage Accumulator annuity.

Company Founded: 1906

Excellent Rated

Company

Company Ratings

4.6

- A.M. Best A-

Assets: $793,164,223

Texas

Other Capitol Life Products

Similar Products

Thrivent Multi-Year Guarantee Annuity with ROP

A++

4.25%

Earnings from $100K

$13,300

Term

3yrs

Secure Summit with 10% Free Withdrawal and RMD

B-

5.50%

Earnings from $100K

$45,468

Term

7yrs