Apollo - MVA (Variation States) ages 60+

The Apollo - MVA Fixed Annuity is a smart choice for those conscious about safety and seeking financial security. This single premium deferred annuity allows you to contribute a minimum of $5,000, offers systematic withdrawal of interest, and has a variety of income options for added flexibility. The greatest advantage it offers is a guaranteed growth, providing a steady income stream that you'll never outlive. Plus, it's a long-term contract, enhancing the stability of your principal and future financial security.

You also have a death benefit that goes straight to your chosen beneficiary upon your death. Perhaps one of its appealing features is the penalty-free access should you need to withdraw more than the allowed amount during the first seven contract years. This gives you some peace of mind in times of need. The funding options are wide, catering to both traditional retirees and those looking to convert traditional IRAs to Roth IRAs. Whichever way you look at it, the Apollo - MVA Annuity provides a sound foundation for a worry-free retirement.

Apollo - MVA (Variation States) ages 60+

About Product

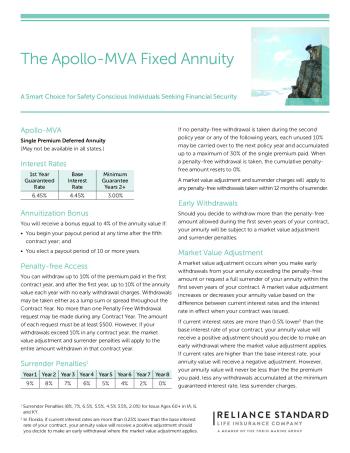

Traditional Fixed Annuity Interest Rates

| Surrender Years | First Year Yield | Term Guaranteed Yield | Term Current Yield |

|---|---|---|---|

| 7 | 6.4% | 3.49% | 4.69% |

Minimum Premium:

- $5,000

- Age 0-75 - $1,000,000

- Age 76-85 - $500,000

Income Options

- Life annuity—A monthly income payable over the annuitant’s lifetime.

- Life annuity with payments certain—A monthly income payable over the annuitant’s lifetime with the additional guarantee that in the event of death prior to the end of the specified period (such as 5, 10 or as long as 20 years), payments will continue to your designated beneficiary for the remainder of the specified period.

- Designated period annuity—A monthly income payable in equal installments for a specified period (such as 5, 10 or as long as 20 years).

- Joint and last survivor annuity—A monthly income payable over the lifetime of an annuitant and thereafter during the lifetime of a designated surviving annuitant.

Death Benefit

Your annuity contract’s death benefit is payable to your beneficiary upon your death. If you are also the annuitant, then your policy’s death benefit will be equal to the annuity’s value. If the annuitant is someone other than you, the policy’s death benefit is equal to the annuity value less any applicable surrender charges.

During the first 12 months of your contract, you can withdraw up to 10% of the single premium paid penalty-free, and, in any contract year thereafter, up to 10% of the annuity value penalty-free. If you should withdraw more than the penalty-free amount in any contract year, the entire amount withdrawn during that contract year is subject to the applicable MVA and surrender charges.

Cumulative Withdrawal Benefit

If no penalty-free withdrawal is taken in contract year two or any contract year thereafter, the amount of that contract years penalty-free withdrawal may be carried over into the following year. If no withdrawals are made for one or more successive years, the penalty-free withdrawal will accumulate up to a maximum penalty-free withdrawal limit of 30% of the single premium paid. Any penalty-free withdrawal carry over balance will return to zero as soon as a penalty free withdrawal of any amount is taken.

Riders

No Riders for Apollo - MVA (Variation States) ages 60+ annuity.

Waivers

Hospital

The event of hospitalization or nursing home confinement, an annuity rider gives you an increased level of penalty-free access to the annuity value as follows: If the annuitant is admitted to a qualified nursing care facility (as defined in the contract) following the end of the first Contract Year and remains in such facility for ninety consecutive days, up to 25% of the annuity value may be withdrawn without penalty in each Contract Year so long as the annuitant remains in such facility. This rider is only available when the annuitant’s age at the issuance of the annuity contract would be 74 or younger and continues until the contract terminates.

Nursing Home

The event of hospitalization or nursing home confinement, an annuity rider gives you an increased level of penalty-free access to the annuity value as follows: If the annuitant is admitted to a qualified nursing care facility (as defined in the contract) following the end of the first Contract Year and remains in such facility for ninety consecutive days, up to 25% of the annuity value may be withdrawn without penalty in each Contract Year so long as the annuitant remains in such facility. This rider is only available when the annuitant’s age at the issuance of the annuity contract would be 74 or younger and continues until the contract terminates. The nursing home waiver does not include home health care.

Annuitization

After 5th policy year with an option lasting at least 6 years.

- A.M. Best A++

- S&P A+

- Moody's A1

- Comdex 91

Other Reliance Standard Products

Similar Products