Index Advantage+

The Index Advantage+ is a win-win! Offering flexible premium payments and options to grow your savings. It's like having a safety net, ensuring your retirement funds are secure, rain or shine.

And, with its income rider, you'll enjoy guaranteed returns, providing that much-needed security in your golden years. Get peace of mind with Index Advantage+!

Index Advantage+

About Product

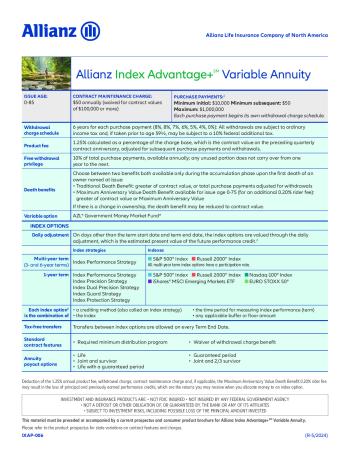

Product and Rider Fees

Product Fee is 1.25%

Rider fee is 0.20% for the maximum Anniversary Valued Death Benefit. If you select this benefit, you will pay 1.45% in total annual contract fees. (product fee plus the rider fee).

Other Contract Fees and Expenses

- An 8.5 declining withdrawal charge applies to withdrawals taken within six years after receipt of each Purchase Payment during the accumulation phase.

- $50 contract maintenance charge assessed annually if the total Contract Value is less than $100,000.

Variable Options

Blackrock

AZL Government Money Market Fund

Other Expenses for the AZL Government Money Market Fund include a recoupment of prior waived fees in the amount of 0.24%. The Manager has voluntarily undertaken to waive, reimburse, or pay the Fund’s expenses to the extent necessary in order to maintain a minimum daily net investment income for the Fund of 0.00%. The recoupment of prior waived fees reflects the recoupment of amounts previously waived, reimbursed, or paid by the Manager under this arrangement. Such recoupments are subject to the following limitations: (1) the repayments will not cause the Fund’s net investment income to fall below 0.00%; (2) the repayments must be made no later than three years after the end of the fiscal year in which the waiver, reimbursement, or payment took place; and (3) any expense recovery paid by the Fund will not cause its expense ratio to exceed 0.87%. See the Investment Option prospectus for further information.

Performance Lock and Early Reallocations

Allows you to capture the current Index Option Value during the Term for an Index Option. Can help eliminate doubt about future Index performance and possibly limit the impact of negative performance. Can allow you to transfer out of an Index Option before the Term End Date.

Allocation Accounts

| Name | Type | Rates |

|---|---|---|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

10.6%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

9%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

11%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

12%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

10.5%

Performance triggered

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

Triennial

|

110%

Participation

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

Triennial

|

100%

Participation

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

Triennial

|

105%

Participation

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

6-Year

|

110%

Participation

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

6-Year

|

110%

Participation

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

6-Year

|

105%

Participation

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

6-Year

|

100%

Participation

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

13.75%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

11.25%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

18.5%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

13.75%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

14.25%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

11.5%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

17.75%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

13%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

26.75%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

21.25%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

23.75%

Cap

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

Triennial

|

100%

Participation

90%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

30.25%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

23%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

27%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

33.25%

Cap

|

| 1-Year Russell 2000 PTP Cap Guard Strategy |

Point to Point

Annual

|

21.5%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Guard Strategy |

Point to Point

Annual

|

22.75%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Guard Strategy |

Point to Point

Annual

|

33%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Guard Strategy |

Point to Point

Annual

|

17.75%

Cap

|

| 1-Year S&P 500 PTP Cap Guard Strategy |

Point to Point

Annual

|

17%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF Protection Strategy |

Performance Triggered

Annual

|

6.7%

Performance triggered

|

| 1-Year EURO STOXX 50 Protection Strategy |

Performance Triggered

Annual

|

8.8%

Performance triggered

|

| 1-Year S&P 500 Protection Strategy |

Performance Triggered

Annual

|

7.3%

Performance triggered

|

| 1-Year Russell 2000 Protection Strategy |

Performance Triggered

Annual

|

8.1%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Precision Strategy |

Performance Triggered

Annual

|

10.8%

Performance triggered

|

| 1-Year Russell 2000 Precision Strategy |

Performance Triggered

Annual

|

14.9%

Performance triggered

|

| 1-Year EURO STOXX 50 Precision Strategy |

Performance Triggered

Annual

|

14.6%

Performance triggered

|

| 1-Year S&P 500 Precision Strategy |

Performance Triggered

Annual

|

12%

Performance triggered

|

| 1-Year Nasdaq-100 Precision Strategy |

Performance Triggered

Annual

|

13.5%

Performance triggered

|

| 1-Year Nasdaq-100 Protection Strategy |

Performance Triggered

Annual

|

7.6%

Performance triggered

|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

6.4%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

8%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

6.7%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

6.8%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

8.3%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

6.8%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

7.1%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

5.9%

Performance triggered

|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

7.7%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

8.6%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Triennial

|

26%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Triennial

|

32%

Performance triggered

|

| 3-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Triennial

|

24%

Performance triggered

|

| 3-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Triennial

|

28%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

6-Year

|

47%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

6-Year

|

54%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

6-Year

|

45%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

6-Year

|

51%

Performance triggered

|

| 3-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Triennial

|

21%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

6-Year

|

40%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

6-Year

|

41%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Triennial

|

22%

Performance triggered

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

Triennial

|

100%

Participation

65%

Cap

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

Triennial

|

100%

Participation

55%

Cap

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

6-Year

|

100%

Participation

125%

Cap

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

6-Year

|

100%

Participation

|

Surrender schedule

| Year | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Penalty | 8% | 8% | 7% | 6% | 5% | 4% |

Riders

| Name | Inbuilt | Fee |

|---|---|---|

| Maximum Anniversary Value Death Benefit | No | 0.20% annually |

Waivers

Hospital

Unavailable in states: MA

Waiver of Withdrawal Charge Benefit After the first Contract year, you can take withdrawals and we waive the withdrawal charge if you: -have to stay in an eligible facility (a hospital, nursing facility, or assisted living facility) for at least 90 days in a 120 period, or -are unable to perform at least two of six activities of daily living (ADLs) for at least 90 consecutive days.

Nursing Home

Unavailable in states: MA

Waiver of Withdrawal Charge Benefit After the first Contract year, you can take withdrawals and we waive the withdrawal charge if you: -have to stay in an eligible facility (a hospital, nursing facility, or assisted living facility) for at least 90 days in a 120 period, or -are unable to perform at least two of six activities of daily living (ADLs) for at least 90 consecutive days.

Premium Notes

age 85 or younger if you select the traditional death Benefit, or age 75 or younger if you select the Maximum Anniversary Value Death Benefit.

Withdrawal Provisions

Free Withdrawal Privilege10% of total purchase payments, available annually/ any unused portion does not carry over from one year to the nextAnnuity Payout OptionsLifeJoint and survivorLIfe with a guaranteed periodGuaranteed periodJoint and 2/3 survivor

- A.M. Best A+

- S&P AA

- Moody's Aa3

- Comdex 96