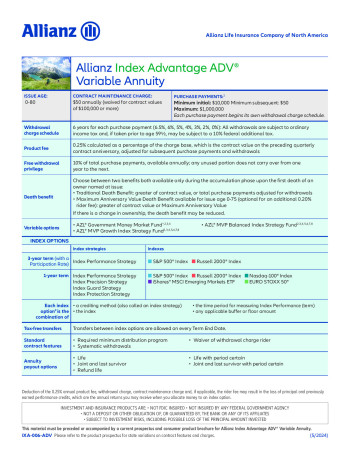

Index Advantage ADV

The Index Advantage ADV annuity is an absolute gem for those looking towards a financially secure retirement. With a strong focus on protecting your investment while offering growth opportunities linked to market performance, it adds a comforting layer of financial certainty.

What's remarkable is its flexible design that allows for customization based on individual needs. Whether you want to ensure a steady income for the years to come or you're looking for a potent wealth-building tool, this annuity caters to all. Give it a try!

Index Advantage ADV

About Product

Product and Rider Fees

Accrued daily and deducted on each Quarterly Contract Anniversary (the day that occurs three

calendar months after the Issue Date or any subsequent Quarterly Contract Anniversary). Each fee is calculated as a percentage of the Charge Base (the Contract Value on the preceding Quarterly

Contract Anniversary, adjusted for subsequent Purchase Payments and withdrawals).

- Your contract has a 0.25% annual product fee calculated as a percentage of the charge base, which is the contract value on the preceding quarterly contract anniversary, adjusted for subsequent purchase payments and withdrawals. Refer to the product brochure for more information on definitions of terms.

- Rider fee is 0.20% for the Maximum Anniversary Value Death Benefit. If you select this benefit, you will pay 0.45% in total annual Contract fees (product fee plus the rider fee).

- A 6.5% declining withdrawal charge applies to withdrawals taken from the Index Options within six years after receipt of each Purchase Payment during the Accumulation Phase. The withdrawal. the charge does not apply to withdrawals from the Variable Options.

- $50 contract maintenance charge assessed annually if the total Contract Value is less than $100,000.

- $25 fee per transfer if you make more than twelve transfers between Variable Options in a Contract Year.

- Variable Option operating expenses before fee waivers and expense reimbursements of 0.67% to 0.88% of the average daily net assets.

Variable Options

Blackrock

AZL Government Money Market Fund

Other Expenses for the AZL Government Money Market Fund include a recoupment of prior waived fees in the amount of 0.24%. The Manager has voluntarily undertaken to waive, reimburse, or pay the Fund’s expenses to the extent necessary in order to maintain a minimum daily net investment income for the Fund of 0.00%. The recoupment of prior waived fees reflects the recoupment of amounts previously waived, reimbursed, or paid by the Manager under this arrangement. Such recoupments are subject to the following limitations: (1) the repayments will not cause the Fund’s net investment income to fall below 0.00%; (2) the repayments must be made no later than three years after the end of the fiscal year in which the waiver, reimbursement, or payment took place; and (3) any expense recovery paid by the Fund will not cause its expense ratio to exceed 0.87%. See the Investment Option prospectus for further information.

Allianz Fund of Funds

AZL MVP Balanced Index Strategy Fund

AZL MVP Growth Index Strategy Fund

The underlying funds may pay 12b-1 fees to the distributor of the Contracts for distribution and/or administrative services. The underlying funds do not pay service fees or 12b-1 fees to the Allianz Fund of Funds and the Allianz Fund of Funds do not pay service fees or 12b-1 fees. The underlying funds of the Allianz Fund of Funds may pay service fees to the insurance companies issuing variable contracts, or their affiliates, for providing customer service and other administrative services to contract purchasers. The amount of such service fees may vary depending on the underlying fund.

The tool does not take into account any allocation to the variable options. Your results would be different if allocated to the variable options. The annual product fee of 0.25%, withdrawal charges, contract maintenance charges, and, if applicable, any rider fees are not reflected and, if deducted, would lower the results shown. You should consider all of a product's features and benefits and consult with a financial professional regarding your investment objectives and risk tolerance before purchasing a variable annuity.

Allocation Accounts

| Name | Type | Rates |

|---|---|---|

| 3-Year S&P 500 PTP Cap Performance Strategy |

Point to Point

Triennial

|

85%

Cap

|

| 1-Year S&P 500 PTP Cap Guard Strategy |

Point to Point

Annual

|

15.25%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Guard Strategy |

Point to Point

Annual

|

16.25%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Guard Strategy |

Point to Point

Annual

|

29.5%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Guard Strategy |

Point to Point

Annual

|

22%

Cap

|

| 1-Year Russell 2000 PTP Cap Guard Strategy |

Point to Point

Annual

|

20.25%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy |

Point to Point

Annual

|

21.25%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy |

Point to Point

Annual

|

31%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy |

Point to Point

Annual

|

23%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy |

Point to Point

Annual

|

21%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy |

Point to Point

Annual

|

29%

Cap

|

| 3-Year Russell 2000 PTP Cap Performance Strategy |

Point to Point

Triennial

|

85%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF Precision Strategy |

Performance Triggered

Annual

|

10.9%

Performance triggered

|

| 1-Year Russell 2000 Precision Strategy |

Performance Triggered

Annual

|

14.3%

Performance triggered

|

| 1-Year EURO STOXX 50 Precision Strategy |

Performance Triggered

Annual

|

13.5%

Performance triggered

|

| 1-Year S&P 500 Precision Strategy |

Performance Triggered

Annual

|

11.9%

Performance triggered

|

| 1-Year Nasdaq-100 Precision Strategy |

Performance Triggered

Annual

|

14%

Performance triggered

|

| 1-Year EURO STOXX 50 Protection Strategy |

Performance Triggered

Annual

|

8.1%

Performance triggered

|

| 1-Year S&P 500 Protection Strategy |

Performance Triggered

Annual

|

7.8%

Performance triggered

|

| 1-Year Russell 2000 Protection Strategy |

Performance Triggered

Annual

|

8.3%

Performance triggered

|

| 1-Year Nasdaq-100 Protection Strategy |

Performance Triggered

Annual

|

7.8%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Protection Strategy |

Performance Triggered

Annual

|

6.8%

Performance triggered

|

Surrender schedule

| Year | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Penalty | 7% | 6% | 5% | 4% | 3% | 2% |

Riders

| Name | Inbuilt | Fee |

|---|---|---|

| Maximum Anniversary Value Death Benefit | No | 0.20% annually |

Waivers

Nursing Home

In most states, this benefit allows you to take a withdrawal without incurring a withdrawal charge if you are confined to a nursing home for a period of at least 90 consecutive days.

Premium Notes

Withdrawal Provisions

Free withdrawal privilege 10% of total purchase payments, available annually; any unused portion does not carry over from one year to the next. On a full withdrawal these free withdrawals may be subject to a withdrawal charge as described in the prospectus Systematic Withdrawal ProgramProvides automatic withdrawals of at least $100 to you at a frequency you select. The withdrawals reduce the amount available under the free withdrawal privilege but are not subject to a withdrawal charge if you exceed the free withdrawal privilege.The systematic withdrawal program can provide automatic withdrawal payments to you. However, if your Contract Value is less than $25,000, we only make annual payments.

- A.M. Best A+

- S&P AA

- Moody's Aa3

- Comdex 96