Index Advantage Income ADV

The Index Advantage Income ADV Annuity is a safe and steady financial friend in retirement. Its standout feature is guaranteeing you a lifetime income stream, giving you certainty and peace.

Worried about outliving your savings? Not with this product. It also offers potential for higher returns based on market performance. Relax knowing your future is secure!

Index Advantage Income ADV

About Product

- accumulating retirement savings and

- receiving income in the form of lifetime withdrawals.

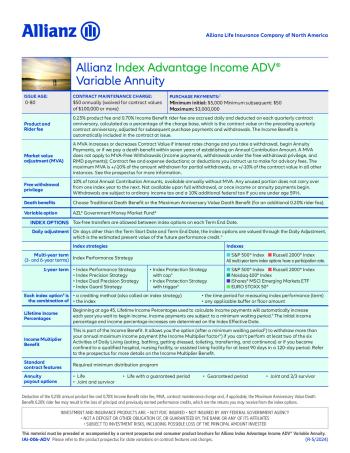

Accrued daily and deducted on each Quarterly Contract Anniversary. Each fee is calculated as a percentage of the Charge Base ( the Contract Value on the preceding Quarterly Contract Anniversary, adjusted for subsequent Purchase Payments and withdrawals).

- Product Fee is 0.25%

- Rider Fee is 0.70% for the Income Benefit.

Other Contract Fees and Expenses:

- Withdrawal charge

- $50 contract maintenance charge assessed annually if the total Contract Value is less than $100,000.

Allocation Accounts

| Name | Type | Rates |

|---|---|---|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

10.1%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

8.5%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

10.4%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

11.2%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

9.5%

Performance triggered

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

Triennial

|

100%

Participation

50%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

19%

Cap

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

6-Year

|

100%

Participation

125%

Cap

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

6-Year

|

100%

Participation

135%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

11.75%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

9.5%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

14.5%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

11.75%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

13%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

10%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

14%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

11.25%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

25%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

16.5%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Protection Strategy |

Point to Point

Annual

|

9.5%

Cap

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

Triennial

|

100%

Participation

60%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

22.75%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

20%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

24.5%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

30%

Cap

|

| 1-Year S&P 500 PTP Cap Guard Strategy |

Point to Point

Annual

|

14.5%

Cap

|

| 1-Year Russell 2000 PTP Cap Guard Strategy |

Point to Point

Annual

|

18.5%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Guard Strategy |

Point to Point

Annual

|

14.5%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Guard Strategy |

Point to Point

Annual

|

16%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Guard Strategy |

Point to Point

Annual

|

26%

Cap

|

| 1-Year S&P 500 PTP Cap Protection Strategy |

Point to Point

Annual

|

7%

Cap

|

| 1-Year Russell 2000 PTP Cap Protection Strategy |

Point to Point

Annual

|

8%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Protection Strategy |

Point to Point

Annual

|

7%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Protection Strategy |

Point to Point

Annual

|

8.25%

Cap

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

6-Year

|

105%

Participation

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

Triennial

|

100%

Participation

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

Triennial

|

100%

Participation

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

6-Year

|

105%

Participation

|

| 1-Year EURO STOXX 50 Protection Strategy with Trigger |

Performance Triggered

Annual

|

7.1%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Protection Strategy with Trigger |

Performance Triggered

Annual

|

6.3%

Performance triggered

|

| 1-Year Nasdaq-100 Protection Strategy with Trigger |

Performance Triggered

Annual

|

6.4%

Performance triggered

|

| 1-Year Russell 2000 Protection Strategy with Trigger |

Performance Triggered

Annual

|

6.8%

Performance triggered

|

| 1-Year S&P 500 Protection Strategy with Trigger |

Performance Triggered

Annual

|

6.2%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Precision Strategy |

Performance Triggered

Annual

|

10.2%

Performance triggered

|

| 1-Year EURO STOXX 50 Precision Strategy |

Performance Triggered

Annual

|

14%

Performance triggered

|

| 1-Year Nasdaq-100 Precision Strategy |

Performance Triggered

Annual

|

12.8%

Performance triggered

|

| 1-Year Russell 2000 Precision Strategy |

Performance Triggered

Annual

|

14.1%

Performance triggered

|

| 1-Year S&P 500 Precision Strategy |

Performance Triggered

Annual

|

11.1%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

8%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

5.9%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

7.1%

Performance triggered

|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

6.1%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

6.7%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

5.5%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

7.9%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

6.4%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

6.3%

Performance triggered

|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

7.2%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Triennial

|

23%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Triennial

|

29%

Performance triggered

|

| 3-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Triennial

|

22%

Performance triggered

|

| 3-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Triennial

|

26%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

6-Year

|

41%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

6-Year

|

47%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

6-Year

|

38%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

6-Year

|

44%

Performance triggered

|

| 3-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Triennial

|

18%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

6-Year

|

36%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

6-Year

|

34%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Triennial

|

20%

Performance triggered

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

Triennial

|

100%

Participation

45%

Cap

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

Triennial

|

100%

Participation

33%

Cap

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

6-Year

|

100%

Participation

80%

Cap

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

6-Year

|

100%

Participation

100%

Cap

|

Riders

| Name | Inbuilt | Fee |

|---|---|---|

| Maximum Anniversary Value Death Benefit | No | 0.20% annually |

| Index Advantage Income ADV Level | Yes | 0.70% annually |

| Index Advantage Income ADV Increasing | Yes | 0.70% annually |

Waivers

No Waivers for Index Advantage Income ADV annuity.

Premium Notes

- Level Income

Consistent, dependable income for life. This may be a good choice if you want the reassurance of knowing exactly how much income you’ll receive annually and if you want a guaranteed stream of income that you can’t outlive. - Increasing Income

Guaranteed income for life – plus an opportunity for payment increases. This offers a smaller payment upfront compared to the Level Income option, with the potential to increase each year by credits earned by your selected index options.

Withdrawal Provisions

Free Withdrawal Privilege10% of total Annual Contribution Amounts, available annually without any MVA applied; any unused portion does not carry over from one index year to the next. On a full withdrawal, prior free withdrawals may be subject to an MVA as described in the prospectus. The free withdrawal privilege is not available on full withdrawals and is no longer available once income payments or annuity payments begin. All withdrawals are subject to ordinary income tax and, if taken prior to age 59 1/2, may be subject to a 10% federal additional tax.

- A.M. Best A+

- S&P AA

- Moody's Aa3

- Comdex 96