Index Advantage+ Income

The Index Advantage+ Income goes beyond being a mere annuity. It's a reliable friend that ensures a steady income during your golden years. Its sturdy earnings and sturdy growth make it a smart, future-loving choice.

Want a relaxing retirement? This product has benefits such as flexible withdrawals and profit participation. This isn't just financial security, it's peace of mind. The Index Advantage+ income is definitely worth considering!

Index Advantage+ Income

About Product

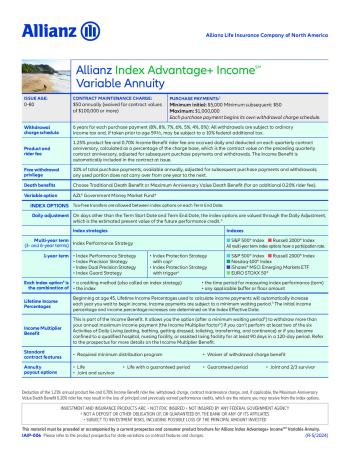

Accrued daily and deducted on each Quarterly Contract Anniversary. Each fee is calculated as a percentage of the Charge Base ( the Contract Value on the preceding Quarterly Contract Anniversary, adjusted for subsequent Purchase Payments and withdrawals).

- Product Fee is 1.25%

- Rider Fee is 0.70% for the Income Benefit.

- Rider fee is 0.20% for the Maximum Anniversary Value Death Benefit. If you select this benefit, you will pay 2.15% in total annual Contract fees (product fee plus the rider fees).

- An 8.5% declining withdrawal charge applies to withdrawals taken within six years after receipt of each Purchase Payment during the Accumulation Phase, and during the Income Period to Excess Withdrawals (the amount of any withdrawal taken during an Index Year that when added to other withdrawals and scheduled Income Payments is greater than your annual maximum Income Payment).

- $50 contract maintenance charge assessed annually if the total Contract Value is less than $100,000.

- AZL Government Money Market Fund operating expenses before fee waivers and expense reimbursements of 0.88% of the average daily net assets.

On days other than the Term Start Date and Term End Date the index options are valued through the daily adjustment, which is the estimated present value of the future Performance Credit.

The Daily Adjustment can be negative with the Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy. You will lose money if the Daily Adjustment is negative. The Daily Adjustment could reflect significantly less gain, or more loss than we would apply to an Index Option on the Term End Date. If you select multiple multi-year Term Index Options, there may be no time that any such transaction can be performed without the application of at least one Daily Adjustment.

Allocation Accounts

| Name | Type | Rates |

|---|---|---|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

10.1%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

8.5%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

10.4%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

11.2%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

9.5%

Performance triggered

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

Triennial

|

100%

Participation

50%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

19%

Cap

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

Triennial

|

100%

Participation

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

Triennial

|

100%

Participation

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

6-Year

|

105%

Participation

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

6-Year

|

105%

Participation

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

6-Year

|

100%

Participation

125%

Cap

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

6-Year

|

100%

Participation

135%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

11.75%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

9.5%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

14.5%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

11.75%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

13%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

10%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

14%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

11.25%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

25%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

16.5%

Cap

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

Triennial

|

100%

Participation

60%

Cap

|

| 1-Year S&P 500 PTP Cap Guard Strategy |

Point to Point

Annual

|

14.5%

Cap

|

| 1-Year Russell 2000 PTP Cap Guard Strategy |

Point to Point

Annual

|

18.5%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Guard Strategy |

Point to Point

Annual

|

14.5%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

30%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Guard Strategy |

Point to Point

Annual

|

16%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Guard Strategy |

Point to Point

Annual

|

26%

Cap

|

| 1-Year S&P 500 PTP Cap Protection Strategy |

Point to Point

Annual

|

7%

Cap

|

| 1-Year Russell 2000 PTP Cap Protection Strategy |

Point to Point

Annual

|

8%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Protection Strategy |

Point to Point

Annual

|

7%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Protection Strategy |

Point to Point

Annual

|

8.25%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Protection Strategy |

Point to Point

Annual

|

9.5%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

24.5%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

20%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

22.75%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF Precision Strategy |

Performance Triggered

Annual

|

10.2%

Performance triggered

|

| 1-Year S&P 500 Precision Strategy |

Performance Triggered

Annual

|

11.1%

Performance triggered

|

| 1-Year Russell 2000 Precision Strategy |

Performance Triggered

Annual

|

14.1%

Performance triggered

|

| 1-Year Nasdaq-100 Precision Strategy |

Performance Triggered

Annual

|

12.8%

Performance triggered

|

| 1-Year EURO STOXX 50 Precision Strategy |

Performance Triggered

Annual

|

14%

Performance triggered

|

| 1-Year Nasdaq-100 Protection Strategy with Trigger |

Performance Triggered

Annual

|

6.4%

Performance triggered

|

| 1-Year S&P 500 Protection Strategy with Trigger |

Performance Triggered

Annual

|

6.2%

Performance triggered

|

| 1-Year Russell 2000 Protection Strategy with Trigger |

Performance Triggered

Annual

|

6.8%

Performance triggered

|

| 1-Year EURO STOXX 50 Protection Strategy with Trigger |

Performance Triggered

Annual

|

7.1%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Protection Strategy with Trigger |

Performance Triggered

Annual

|

6.3%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

6.7%

Performance triggered

|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

7.2%

Performance triggered

|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

6.1%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

5.9%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

8%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

6.3%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

6.4%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

7.9%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

5.5%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

7.1%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Triennial

|

23%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Triennial

|

29%

Performance triggered

|

| 3-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Triennial

|

22%

Performance triggered

|

| 3-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Triennial

|

26%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

6-Year

|

41%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

6-Year

|

47%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

6-Year

|

38%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

6-Year

|

44%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

6-Year

|

36%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

6-Year

|

34%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Triennial

|

20%

Performance triggered

|

| 3-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Triennial

|

18%

Performance triggered

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

6-Year

|

100%

Participation

100%

Cap

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

6-Year

|

100%

Participation

80%

Cap

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

Triennial

|

100%

Participation

33%

Cap

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

Triennial

|

100%

Participation

45%

Cap

|

Surrender schedule

| Year | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Penalty | 8% | 8% | 7% | 6% | 5% | 4% |

Riders

| Name | Inbuilt | Fee |

|---|---|---|

| Maximum Anniversary Value Death Benefit | No | 0.20% annually |

| Index Advantage Income Benefit Level | Yes | 0.70% annually |

| Index Advantage Income Benefit Increasing | Yes | 0.70% annually |

Waivers

Nursing Home

Unavailable in states: MA

After the first Contract Year, if any Owner becomes confined to a nursing home for a period of at least 90 consecutive days and a physician certifies that continued confinement is necessary, you can take withdrawals and we waive the withdrawal charge. This waiver is not available if any Owner was confined to a nursing home on the Issue Date. We base this benefit on the Annuitant for non-individually owned Contracts. We must receive proof of confinement in Good Order for each withdrawal before we waive the withdrawal charge.

ADL

Unavailable in states: MA

After the first Contract Year, you can take withdrawals and we waive the withdrawal charge if you are unable to perform at least two of six activities of daily living (ADLs) for at least 90 consecutive days. ADLs include bathing, dressing, toileting, continence, eating, and transferring (moving into or out of a bed, chair, or wheelchair).

Premium Notes

On the date we issue the Contract (the Issue Date), all Owners and the Annuitant must be:

- age 80 or younger if you select the Traditional Death Benefit, or

- age 75 or younger if you select the Maximum Anniversary Value Death Benefit. The Owner is the person or entity designated at issue who may exercise all Contract rights. The Annuitant is the individual upon whose life we base Annuity Payments.

Withdrawal Provisions

Free Withdrawal PrivilegeAllows you to withdraw 10% of your total Purchase Payments each Contract Year during the Accumulation Phase and before the Income Period without incurring a withdrawal charge. A Contract Year is any period of twelve months beginning on the Issue Date or a subsequent Contract Anniversary. A Contract Anniversary is a twelve-month anniversary of the Issue Date or any subsequent Contract Anniversary.Any unused free withdrawal privilege in one Contract Year is not added to the amount available in the next Contract Year.If you withdraw more than the free withdrawal privilege we will assess a withdrawal charge if the withdrawal is taken from a Purchase Payment we received within the last six years.Not available if you take a full withdrawal of your total Contract Value or during the Income Period.

- A.M. Best A+

- S&P AA

- Moody's Aa3

- Comdex 96