Index Advantage+ NF

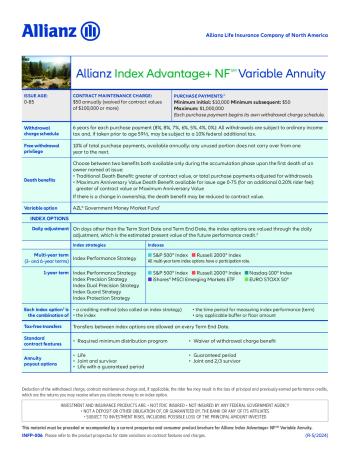

The Index Advantage+ NF is a practical annuity choice, designed to secure your retirement income. With its built-in growth potential and protection from market downturns, it's a safety net for your golden years.

Its flexibility and options for lifetime income add a layer of retirement peace of mind. Ensure for your future that Index Advantage+ NF promises today!

Index Advantage+ NF

About Product

Rider Fee

Rider Fee is 0.20% for the Maximum Anniversary Valued Death Benefit

Variable Options

Blackrock

AZL Government Money Market Fund

Other Expenses for the AZL Government Money Market Fund include a recoupment of prior waived fees in the amount of 0.24%. The Manager has voluntarily undertaken to waive, reimburse, or pay the Fund’s expenses to the extent necessary in order to maintain a minimum daily net investment income for the Fund of 0.00%. The recoupment of prior waived fees reflects the recoupment of amounts previously waived, reimbursed, or paid by the Manager under this arrangement. Such recoupments are subject to the following limitations: (1) the repayments will not cause the Fund’s net investment income to fall below 0.00%; (2) the repayments must be made no later than three years after the end of the fiscal year in which the waiver, reimbursement, or payment took place; and (3) any expense recovery paid by the Fund will not cause its expense ratio to exceed 0.87%. See the Investment Option prospectus for further information.

Daily Adjustment

On days other than the Term Start Date and Term End Date the index options are valued through the daily adjustment, which is the estimated present value of the future Performance Credit.

The Daily Adjustment can be negative with the Index Precision Strategy, Index Guard Strategy, and Index Performance Strategy. You will lose money if the Daily Adjustment is negative. The Daily Adjustment could reflect significantly less gain, or more loss than we would apply to an Index Option on the Term End Date. If you select multiple multi-year Term Index Options, there may be no time that any such transaction can be performed without the application of at least one Daily Adjustment.

Allocation Accounts

| Name | Type | Rates |

|---|---|---|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

8.9%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

7.4%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

9.5%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

10.2%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Annual

|

8.7%

Performance triggered

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

6-Year

|

100%

Participation

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

Triennial

|

100%

Participation

85%

Cap

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

6-Year

|

100%

Participation

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

Triennial

|

100%

Participation

45%

Cap

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

Triennial

|

100%

Participation

40%

Cap

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

6-Year

|

100%

Participation

100%

Cap

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 20% Buffer |

Point to Point

6-Year

|

100%

Participation

100%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

11%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

8.75%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

13%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

10.25%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

11.25%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

8.5%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

11.5%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

9.25%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 20% Buffer |

Point to Point

Annual

|

16.25%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 30% Buffer |

Point to Point

Annual

|

11.75%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

15.25%

Cap

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 10% Buffer |

Point to Point

Triennial

|

100%

Participation

70%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

20%

Cap

|

| 1-Year S&P 500 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

16%

Cap

|

| 1-Year Russell 2000 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

19.75%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Performance Strategy with 10% Buffer |

Point to Point

Annual

|

26.5%

Cap

|

| 1-Year Russell 2000 PTP Cap Guard Strategy |

Point to Point

Annual

|

16.5%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF PTP Cap Guard Strategy |

Point to Point

Annual

|

18%

Cap

|

| 1-Year EURO STOXX 50 PTP Cap Guard Strategy |

Point to Point

Annual

|

23%

Cap

|

| 1-Year Nasdaq-100 PTP Cap Guard Strategy |

Point to Point

Annual

|

13.5%

Cap

|

| 1-Year S&P 500 PTP Cap Guard Strategy |

Point to Point

Annual

|

12%

Cap

|

| 1-Year iShares MSCI Emerging Markets ETF Protection Strategy |

Performance Triggered

Annual

|

5%

Performance triggered

|

| 1-Year EURO STOXX 50 Protection Strategy |

Performance Triggered

Annual

|

6.6%

Performance triggered

|

| 1-Year S&P 500 Protection Strategy |

Performance Triggered

Annual

|

5.5%

Performance triggered

|

| 1-Year Russell 2000 Protection Strategy |

Performance Triggered

Annual

|

6%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Precision Strategy |

Performance Triggered

Annual

|

9.2%

Performance triggered

|

| 1-Year Russell 2000 Precision Strategy |

Performance Triggered

Annual

|

12.7%

Performance triggered

|

| 1-Year EURO STOXX 50 Precision Strategy |

Performance Triggered

Annual

|

12.5%

Performance triggered

|

| 1-Year S&P 500 Precision Strategy |

Performance Triggered

Annual

|

10.3%

Performance triggered

|

| 1-Year Nasdaq-100 Precision Strategy |

Performance Triggered

Annual

|

11.6%

Performance triggered

|

| 1-Year Nasdaq-100 Protection Strategy |

Performance Triggered

Annual

|

5.5%

Performance triggered

|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

5.1%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

6.5%

Performance triggered

|

| 1-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

5.2%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

5.5%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

6.9%

Performance triggered

|

| 1-Year Nasdaq-100 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

5.4%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

5.7%

Performance triggered

|

| 1-Year iShares MSCI Emerging Markets ETF Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Annual

|

4.7%

Performance triggered

|

| 1-Year EURO STOXX 50 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

6.4%

Performance triggered

|

| 1-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Annual

|

7.2%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Triennial

|

21%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Triennial

|

27%

Performance triggered

|

| 3-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

Triennial

|

19%

Performance triggered

|

| 3-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

Triennial

|

23%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

6-Year

|

36%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

6-Year

|

43%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 20% Buffer |

Dual Direction Trigger

6-Year

|

34%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 10% Buffer |

Dual Direction Trigger

6-Year

|

39%

Performance triggered

|

| 6-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

6-Year

|

100%

Participation

75%

Cap

|

| 6-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

6-Year

|

100%

Participation

65%

Cap

|

| 3-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Triennial

|

16%

Performance triggered

|

| 6-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

6-Year

|

32%

Performance triggered

|

| 6-Year S&P 500 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

6-Year

|

30%

Performance triggered

|

| 3-Year Russell 2000 Dual Precision Strategy with 30% Buffer |

Dual Direction Trigger

Triennial

|

17%

Performance triggered

|

| 3-Year Russell 2000 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

Triennial

|

100%

Participation

37%

Cap

|

| 3-Year S&P 500 PTP Participation Rate with Cap Performance Strategy with 30% Buffer |

Point to Point

Triennial

|

100%

Participation

28%

Cap

|

Surrender schedule

| Year | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Penalty | 8% | 8% | 7% | 6% | 5% | 4% |

Riders

| Name | Inbuilt | Fee |

|---|---|---|

| Maximum Anniversary Value Death Benefit | No | 0.20% annually |

Waivers

Nursing Home

Unavailable in states: MA

In most states, this benefit allows you to take a withdrawal without incurring a withdrawal charge if you are confined to a nursing home for a period of at least 90 consecutive days.

ADL

Unavailable in states: MA

After the first Contract Year, you can take withdrawals and we waive the withdrawal charge if you are unable to perform at least two of six activities of daily living (ADLs) for at least 90 consecutive days. ADLs include bathing, dressing, toileting, continence, eating, and transferring (moving into or out of a bed, chair, or wheelchair).

Withdrawal Provisions

Free Withdrawal PrivilegeAllows you to withdraw 10%of your total Purchase Payments each Contract Year during the Accumulation Phase without incurring a withdrawal charge.Any unused free withdrawal privilege in one Contract Year is not added to the amount available in the next Contract Year.If you withdraw more than the free withdrawal privilege, we will assess a withdrawal charge if the withdrawal is taken from a Purchase Payment we received within the last six years.

- A.M. Best A+

- S&P AA

- Moody's Aa3

- Comdex 96